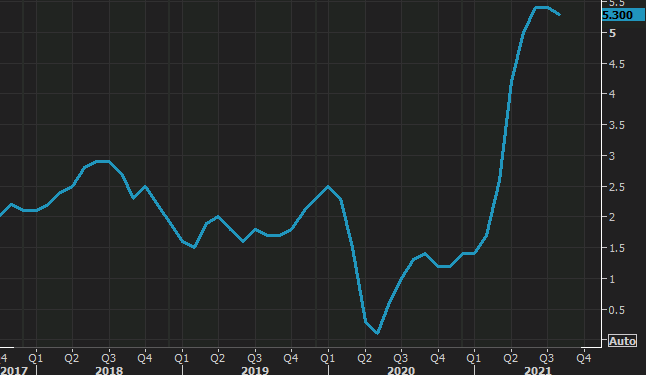

Highlights of the US August 2021 CPI report

- Prior was +5.4%

- m/m CPI +0.3% vs +0.4% expected

- Prior m/m reading was +0.5%

- Real weekly earnings +0.3% vs -0.1% expected

- Full release (pdf)

Core inflation:

- Ex food and energy +4.0% vs +4.2% y/y expected

- Prior ex food and energy +4.3%

- Core m/m +0.1% vs +0.3% exp -- lowest since Feb

- Prior core m/m +0.3%

These numbers are broadly lower than anticipated and the US dollar is down across the board in response by around 20 pips.

The year-over-year chart (above) is starting to look like a covid case count chart that's beginning to roll over. That's exactly what the Fed is looking for via its 'transitory' narrative.

More details:

- Used cars -1.5% m/m vs +0.2% prior

- Used cars +31.9% y/y

- New vehicles +1.2% vs +1.7% m/m prior

- New vehicles +7.6% y/y

- Shelter +0.2% vs +0.4% m/m prior (this skews a bit lower because of falling hotel prices)

- Energy +2.0% m/m vs +1.6% m/m prior

- Energy +25% y/y

- Food +0.4% m/m vs +0.7% prior

- Airline fares -9.1% m/m