The US dollar has moved lower after the FOMC meeting minutes showed the Fed’s concern about global growth and it’s own inflation. The dollar was also cited as a risk to exports and growth according to the Fed.

The dollar has been on a mission to the upside over the last few months as the US economy has outperformed. Now the Fed has signaled they too do not want a strong currency (who does). Nevertheless, given the recent strength of the greenback, perhaps there is some further room to correct. Below is a look at the daily or weekly charts for the EURUSD, USDJPY, GBPUSD and AUDUSD and what I see as the key technicals that are in play for those currency pairs should the dollar weakness continue.

EURUSD

EURUSD tests the 2013 low after the FOMC minutes.

The EURUSD has risen up to test the 2013 low price of 1.2746. The high price reached 1.2747 and found sellers on the first test. The pair bottomed after the US employment report on Friday at 1.2500. if the price is able to get above the 1.2757 level, there should be some stops. However, I am not convinced the EUR is better than the USD at 1.2800 and above. It just does not sit well with the fundamental view of the economies no matter what the Fed thinks.

USDJPY

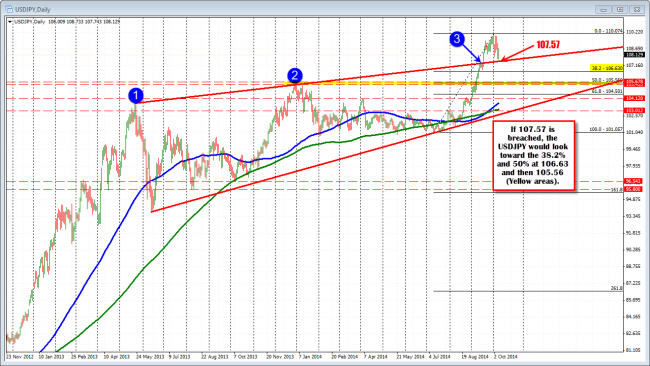

The USDJPY has rallied from a July low near 101.00 to a October high at 110.00 (8.91% rise). Since June 2013, the price has moved up from 93.78 to a high of 110.07 . This is a 17.37% increase in the greenback. The corrective low is back toward the 107.74. The trend line connecting most recent highs comes in at 107.57. A move back below that 107.57 should solicit more selling. I could see a move toward the 106.63 and maybe 105.56, but the buy the dip mentality needs to be broken on a move below the 107.57 level.

The daily chart for the USDJPY shows support at 107.57 on further selling.

GBPUSD

The GBPUSD has pushed further away from the key 1.6000 level after the FOMC meeting minutes. That level is the 50% of the move up from the 2013 lows and also near the 200 week MA (at 1.6010). The 1.6218-81 is the next target. This is where a bunch of lows and highs came in over the last month of trading. The 1.6279 level was the Friday low before the gap down after the Scotland Referendum poll on the weekend of September 5-8. Key target on the topside.

GBPUSD buying has pushed the price further away from the key 1.6000 level

AUDUSD

The AUDUSD – like the GBPUSD – took out key support after Friday’s US employment report. For this pair the price moved below the low for the year at the 0.8659 level. The low reached 0.8642. If the US dollar is to remain weak, the next target would be against the 0.8890 and then 0.8913. The first level is the low from February 2014. The 0.8913 is the 38.2% of the trend move lower from the September high to the October low (from 0.9400 to 0.8642).

The Employment report will be released tomorrow in Australia. In addition, the RBA has stated that they feel their currency is still too high. Then again, if the Fed is concerned about a high currency, who isn’t .

AUDUSD moves away from the 2014 lows. Employment to be released later today.