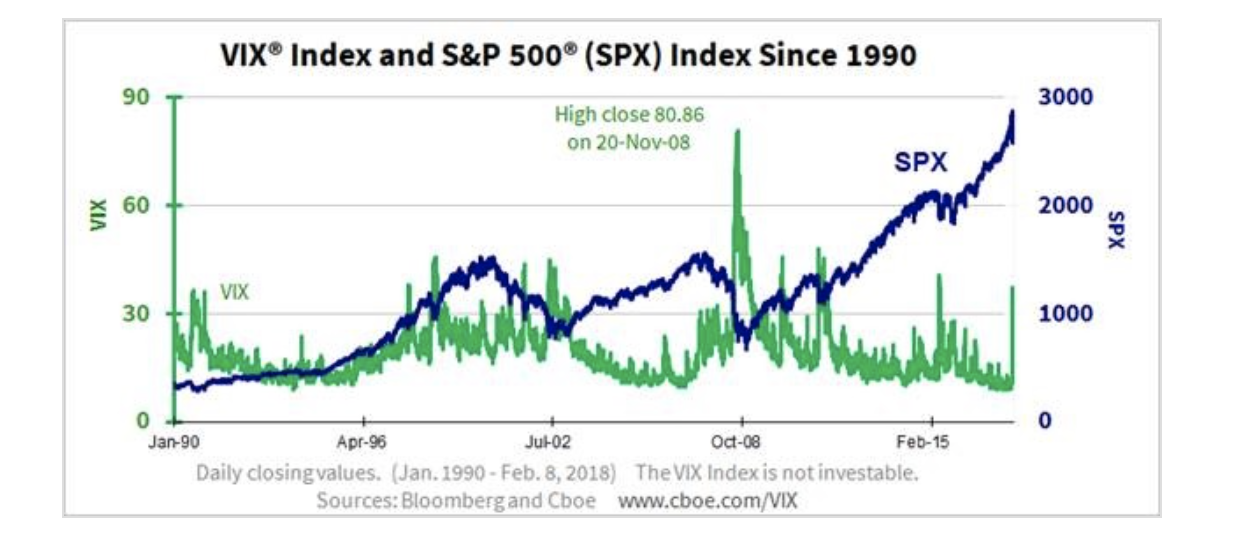

The Vix index is the so called 'fear gauge' for Wall Street. The Vix is meant to be a reflection of the volatility of the S&P 500, based on options prices. When the S&P 500 falls sharply the Vix will rise strongly. This is why it has the association with investor fear.

The Vix surged more than 10 per cent in just a few minutes on Wednesday morning. A trader or group of traders paid $2.1 million for options on the S&P 500 falling 50% in the next month.

According to Pravit Chintawongvanich, head of deriviatives at Macro Risk Advisers, he commented that, "It is highly unusual to see that trading pattern suddenly appear". "Someone was paying a lot of money on options that will most likely expire wothless in a month , pushing the Vix higher. The nefarious explanation is someone was prepared to lose money trading the options in order to make money on Vix positions they had".

This comes on the back of the Financial Industry Regulatory Authority looking into whether the Vix is being manipulated. Last year two academics from the University of Texas claimed that the Vix was being manipulated. Their claims were based upon the auction settlement process and the appearance of large offers to buy and sell out-of-the-money options that affect the value of the Vix. Furthermore, lawyers for an anonymous trader wrote a letter to US regulators in February alleging the Vix was being manipulated by activity in the S&P 500 market.

It was this activity that is alleged to have occurred during Wednesday's auction with the Vix moving from 15 to 17 in just a few minutes

The number of bets on a rising Vix are at a record level with a record long position from "Non-Commercial" accounts (fund managers) on the Vix Futures of 92,913 contracts for the weekend of April 10

more details at the Financial Times...