US July 2021 retail sales data

- Prior was 0.6% MoM (revised to 0.7 %)

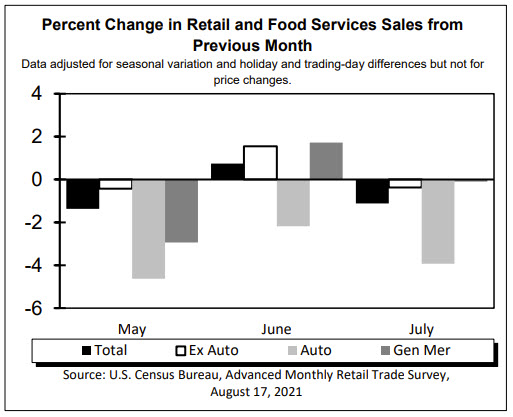

- Retail sales MoM -1.1% vs -0.2% estimate

- Retail ex autos -0.4% vs 0.2% estimate

- Prior ex autos 1.3% (revised to 1.6%)

- Retail sales control group -1.0% vs 1.1 last month

- Retail sales ex auto and gas -0.7% vs 1.4% prior (revised from +1.1%)

- Full report

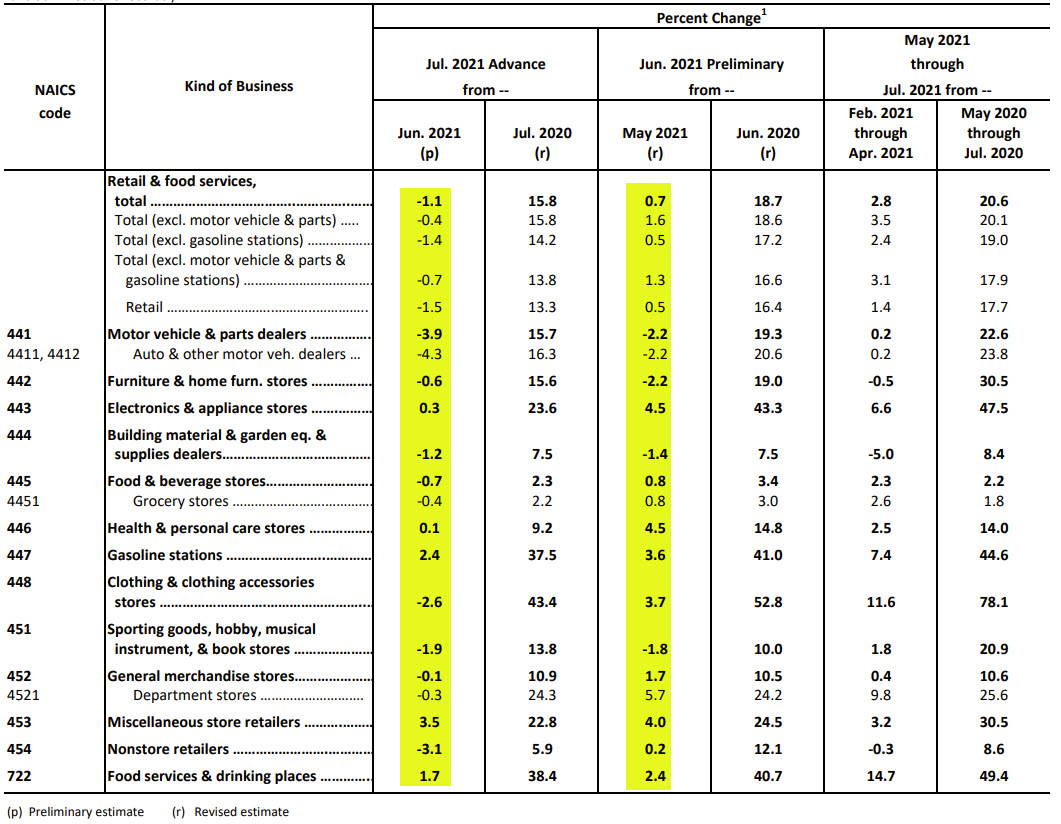

Looking at some of the details:

- motor vehicles and parts dealers -3.9% versus -2.2% last month

- furniture and home furniture stores -0.6% versus -2.2% prior

- electronics and appliance stores +0.3% versus 4.5% prior

- building materials and garden equipment and supplies dealers -1.2% versus -1.4% prior

- food and beverage stores -0.7% versus +0.8% prior

- health and personal care stores 0.1% versus 4.5% prior

- gasoline stations +2.4% versus +3.6% prior

- clothing and clothing accessories -2.6% versus +3.7% prior

- sporting-goods hobbies musical instruments -1.9% versus -1.9% prior

- general merchandise stores -0.1% versus +1.7% prior

- miscellaneous +3.5% versus +4.0%prior

- non-store retailers -3.1% versus +0.2%

- food services and drinking places +1.7% versus +2.4% prior

The data is is disappointing. The consumer represents two thirds of the economy. The Dow futures are implying a -194 point decline. The NASDAQ is getting hit the worst at -86 points. The S&P futures are implying a -21.5 point decline.

Below is the table of changes for June and May (see yellow columns). A total ofeight component categories were down (led by -3.9% motor vehicle and parts dealers. Clothing was also down -2.6%),while 5 were up (led by gasoline sales +2.4% and miscellaneous store retailers +3.5%)