A final look at Fed pricing in the year ahead

There is a solid chance the Federal Reserve delivers a surprise and cuts today, according to market-implied probabilities.

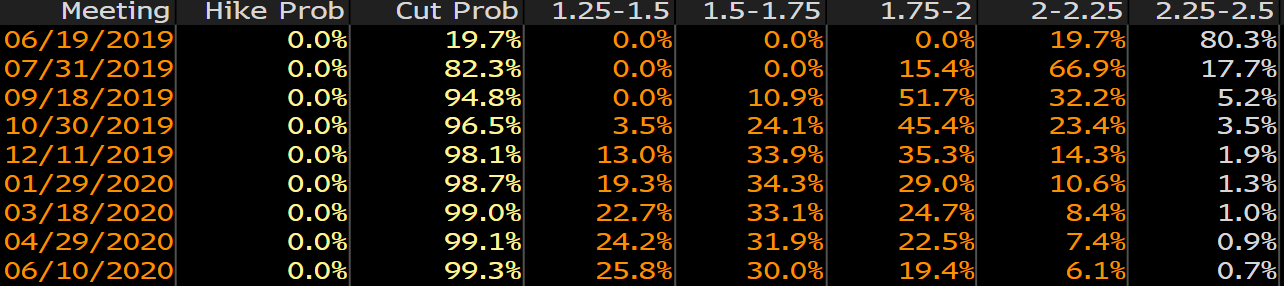

Fed funds traders see a 19.7% chance of a cut to a range of 2-2.25%. The risk in the Fed cutting would be that it would be sending a fearful message like 'we know something you don't' and would have a counter-productive effect. For that reason, and because it would damage the credibility of 'patient' forward guidance, I think the probability is close to zero.

The real intrigue is in the Fed setting up a cut at the July 31 meeting. The implied probability of a cut then is 82%. That's down from as high as 90% last week and the drop is primarily due to a US-Mexico deal and Trump restarting talks with China. In order to sustain that high probability, the statement or comments from Powell will need to include a strong hint at a cut.

My problem is that I believe even a strong hint will have conditionality, likely due to trade. If the Trump-Xi meeting goes well and genuine talks resume, I don't believe the Fed will cut. The other factor to consider is inflation. The Fed has been wrong about inflation for years and is starting to have some self-doubt. Inflation expectations are falling and Fed may want to counteract that.

Beyond July and this year, the tougher question to answer is how much the Fed will cut. The market is pricing in a 42% chance of four or more rate cuts. That's way beyond an insurance cut or something to stabilize inflation expectations. It would take at least a near-recession to cut that much.

If the Fed pushes back, watch for the US dollar to rise and risk aversion to pick up.