The shock drop in the UMich survey could be repeated

I think the market is sleeping on the risks around an ongoing pullback from the US consumer.

US total consumer spending on goods way overshot during the pandemic and just to normalize would be a contraction. Add in delta, evictions and the end of supplementary employment benefits next week and there are far larger risks than almost anyone is talking about.

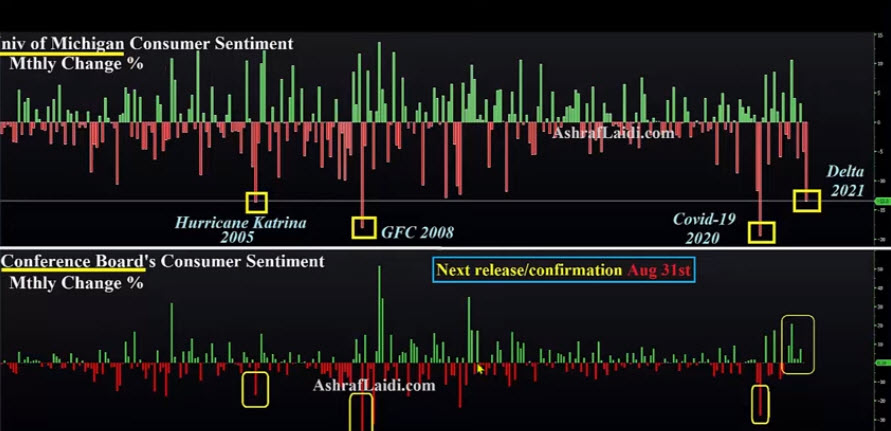

So far, we've had two big disappointing readings in the latest retail sales numbers and the shocking fall in the UMich consumer sentiment report to below the worst of the pandemic.

Today, we get another view on the consumer, this time in the Conference Boards' consumer confidence data for August. The consensus is a fall to 123.0 or 124.0 (depending on the survey) from 129.1, but if it tracks the UMich survey it could be much worse.

Ashraf Laidi talks about the potential for a disappointing reading here and some trades around it.

I agree that risks are to the downside and this reading could finally get the market focused on the weakening US consumer. As a trade, I worry it might get lost in month-end flows but the US dollar could be vulnerable here -- particularly USD/JPY if it comes with risk aversion and falling Treasury yields.