Yen softens, then comes back

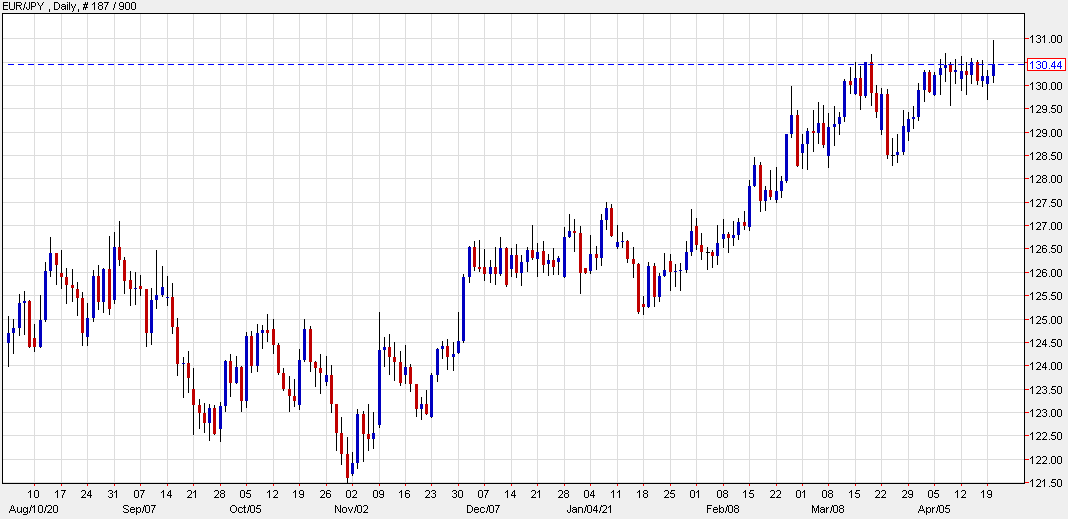

EUR/JPY touched the highest today since 2018 in what looked like a breakout. The high was 130.97 but it ran into offers at 131.00 and has quickly dropped back to 130.41.

That's left the chart looking like this:

Optimism in Europe is building and the real battle between these two is which economy will be the funder. Old habits die hard so the thinking is that Europe will eventually get on its feet at the end of the pandemic and (one day) escape ZIRP.

The bad news is that European cases are still climbing, particularly in France. The thinking though is that this will be the last wave as the virus is overwhelmed by vaccines in May/June when supplies are expected to jump.

It's not just the EUR/JPY chart that's interesting, NZD/JPY broke to a one-month high today but has now fallen back below the old high.

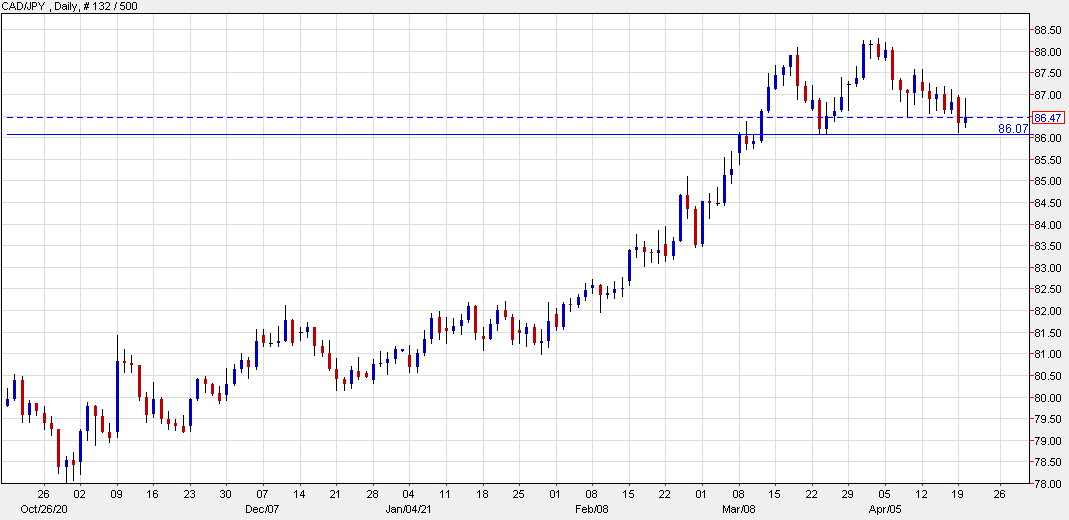

On the flipside is CAD/JPY, which is flirting with a breakdown. The loonie is the laggard this week and the Bank of Canada decision is tomorrow, so this will be a chart to watch. This has been the trade of the year so far, but a break below the mid-March lows could signal a deeper correction.