The market can be tough to digest at times, but it's best not to fight it

It's been a wonky and wild couple of trading days, but we're back to square one - only with heightened volatility in my view.

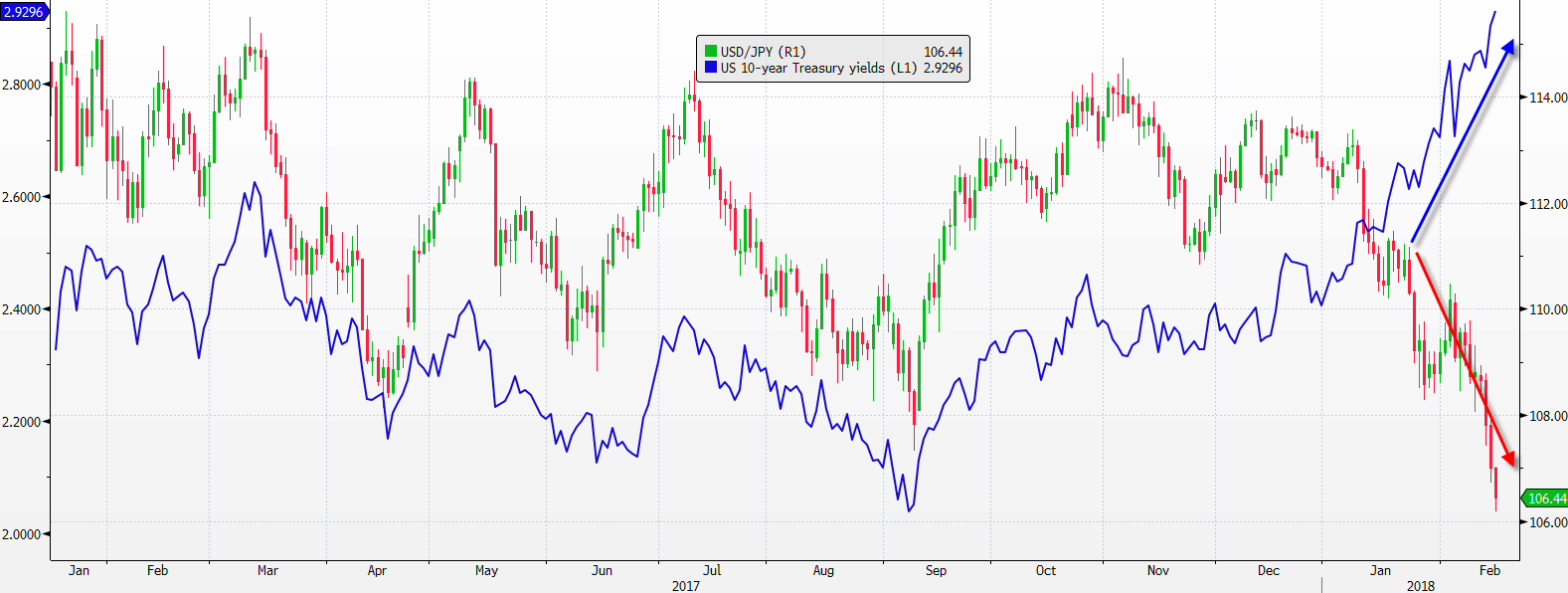

The dollar remains offered again today, as the continuation of the trend since the end of December looks set to extend further into the trading year. January saw a couple of breakdown in correlations, most notably USD/JPY and US 10-year yields - which is something we've been talking about for the past month.

Both have diverged in opposite directions, and if anything, the correlation is starting to turn negative at this point. But the correlation is something that some traders will just keep sticking to, and think that the dollar will come back when the market "corrects" itself.

There will be a time when the correlation resumes again, but for now, we as traders should trade what the market is - and not what it was. If you're planning to ride out the long view, then you'd better make sure you have deep pockets to let it run. Otherwise, trade what you see and trade what is in front of you.

We are not here to argue with the market, we are here to trade with it.

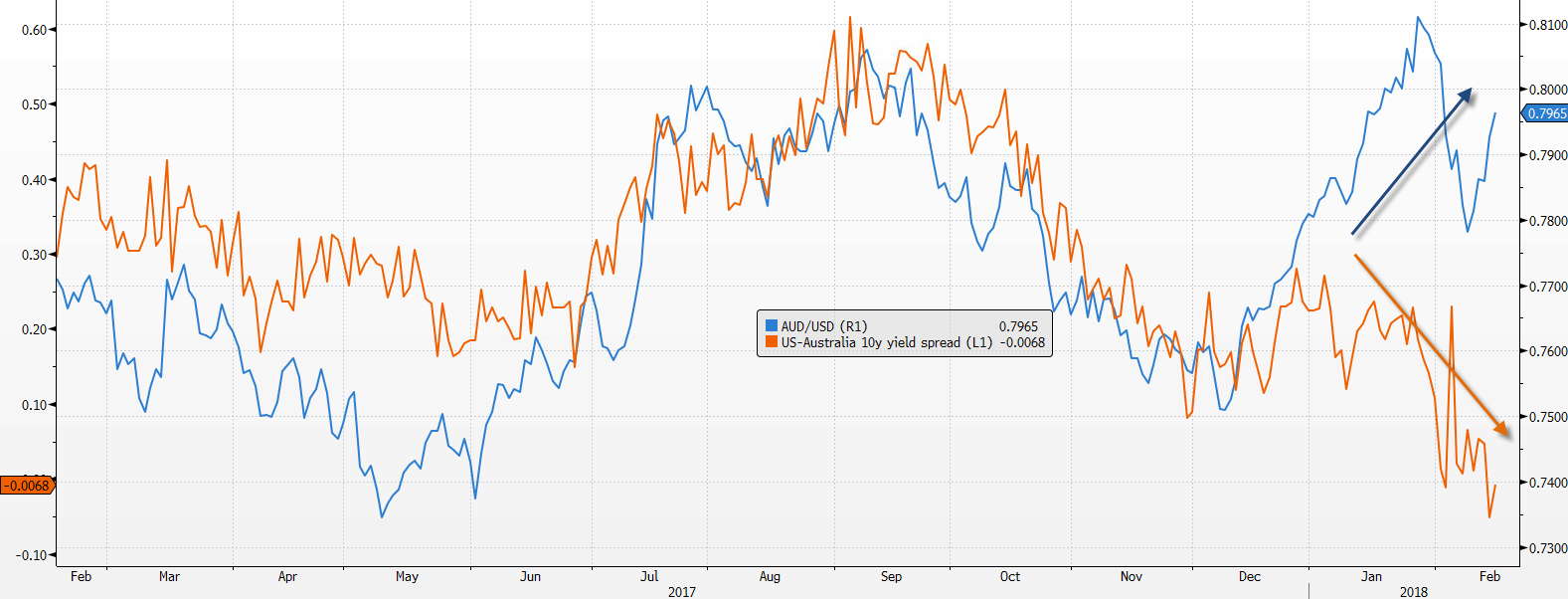

Anyway, further evidence of the breakdown in correlation in yields with the dollar can be seen from the AUD/USD movement. It's something that was highlighted earlier here too.

While US 10-year yields have now climbed above its Australian counterpart, the pair is steadily rising back towards 0.8000 once again.

Broken? The market is never broken, the market will be what it is and that's the way things will always be. And that's okay, because we're here to trade - not to argue whether or not the market is broken.

--