The highlights on the economic calendar on Friday in Europe and the US are business sentiment surveys.

We will get the PMIs from S&P Global for both manufacturing and services:

- Germany

- France

- The eurozone

- The UK

- The United States

- Australia

Given what we've seen from recent survey, including today's Philly Fed, I would bet on downside misses from all of them. Businesses are struggling with supply chains, hiring, cost rises, recession talk and rising interest rates. It's enough to make anyone scared and will mean lower-than-hoped capex and leaner inventories than hoped in the year ahead.

That said, supply chains are now improving, gasoline costs have retraced, other commodity prices have declined and rates hikes are priced in. We may be seeing the worst of sentiment now and in the month ahead.

But what I really want to hire is the persistent idea in all sentiment surveys that 'I'm ok, but everyone else is in trouble'. It's absurd that the UMich survey of consumers is at a record low. People were worried about homelessness, job loss and a Great Depression-style scenario in the financial crisis. Meanwhile there are 11.254 million job openings right now in the US.

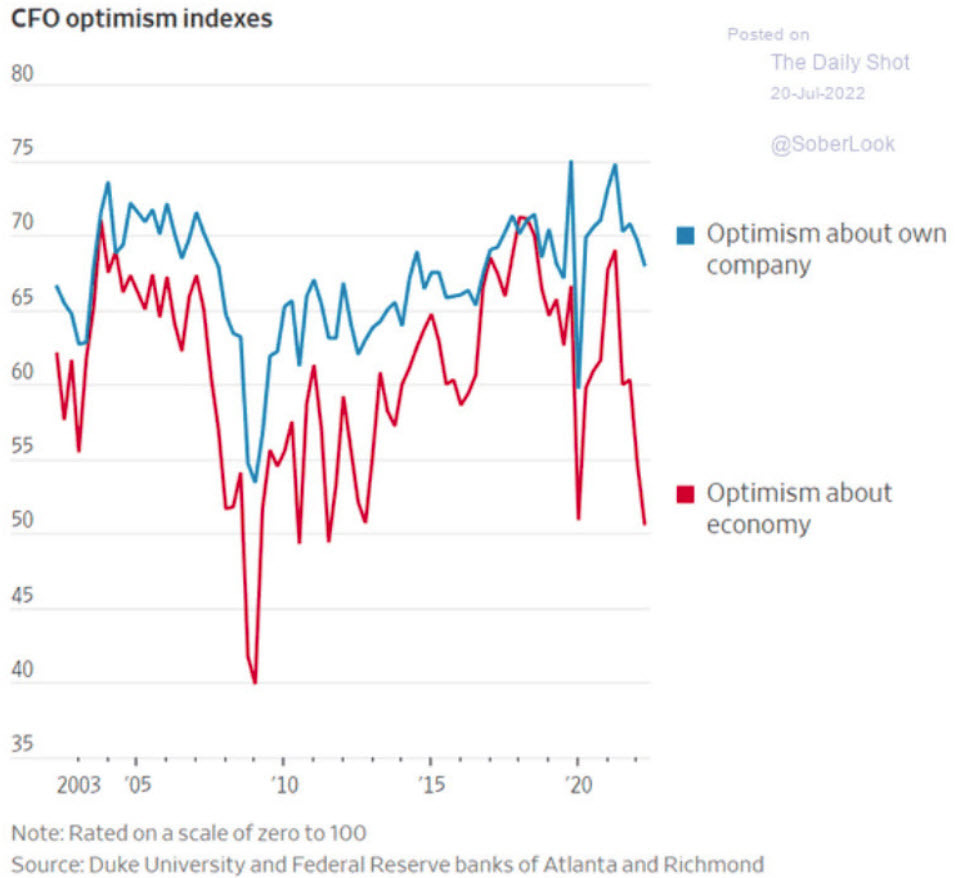

Here's a great chart of CFO optimism with companies feeling great about their own prospects but worries about the economy.

Which of those do you think is more valuable?

The market is worried right now but most CFOs feel good about the thing they know the most about: their own business.

In any case, brace for volatility tomorrow. The times for all the releases are on the economic calendar.