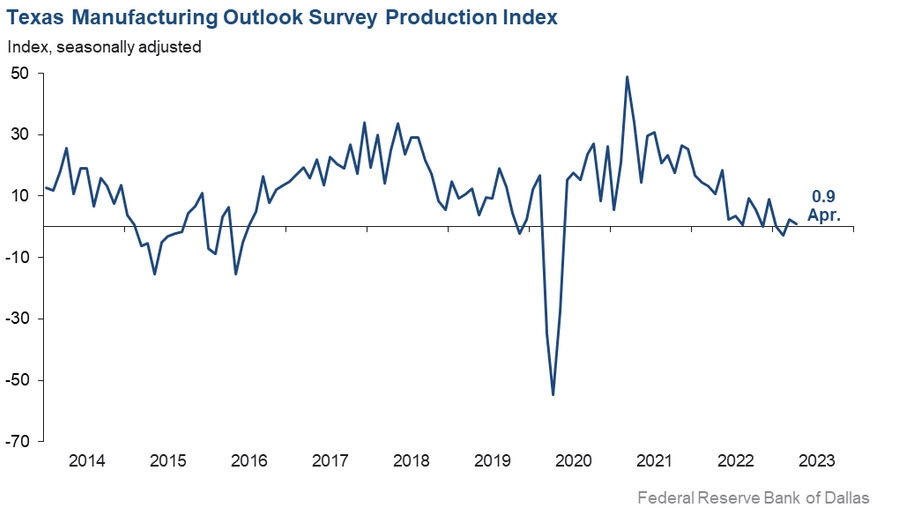

- Prior was -15.7

- Production output +0.9 vs +2.5 prior

- New orders -9.6 vs -14.3 prior

- Shipments -2.8 vs -10.5 prior

- Prices paid +19.5 vs +20.3 prior

- Prices received +8.4 vs +7.0 prior

- Company outlook -15.6 vs -13.3 prior

- Employment +8.0 vs +10.4 prior

This is the lowest reading since July but the underlying numbers aren't as bad as the headline as there are bright spots.

Some of the comments in the report highlight availability problems, which is something the Fed is watching:

- The first quarter came in about as expected; all markets weakened with the exception of automotive. There are signs that inventories are building quickly in auto, so expect that market to weaken soon.

- We have already been notified that our credit line renewal may be difficult. Our monthly increase in costs (rate) is at highs not seen since 2007.

- Funding has dried up to purchase our products.

- There is a definite slowdown. New orders virtually stopped.

- We are starting to see a real slowdown. We are hoping it is short lived

- Almost all of our customers have high inventories from overbuying last year. So, they are all cutting back on ordering new inventory.

- Business has gotten stupid slow, and we estimate having many days of just a few hours’ work due to low volume. This is crazy—as busy as we were last year, and now for this year to have it turn off so quickly, it is hard to understand why. We hear from many others in our industry, and they are all saying the same thing: that it's gotten slower without any signs of turning around in the near term. Perhaps it’s the Federal Reserve actions that are causing this.