We had the Tokyo inflation data for May published four weeks ago; Tokyo area data is seen as a bit of a guide

It was on the up, but the Bank of Japan is not convinced its not transitory and so left policy unchanged at its latest monetary policy meeting:

Confirmed loose policy from the BOJ sent yen crosses skyrocketing, this was a no-brainer:

After an adventure above 136 USD/JPY has turned down:

Higher than expected CPI in the data today will spur talk, again, of BOJ policy change and would be a positive for yen, at the margin.

Apart from the Japan data there is consumer confidence to come from the UK (2301 GMT) for June

- expected -40, prior -40

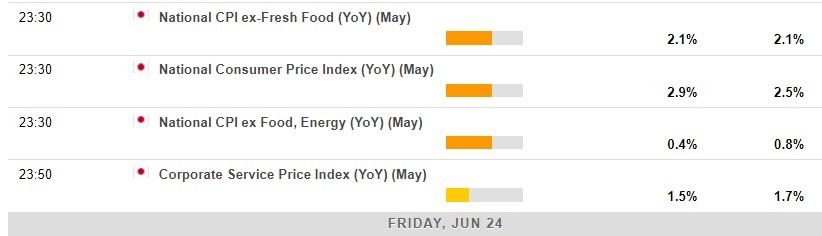

and the Corporate Services Price Index from Japan at 2350 GMT

prior +1.7% y/y