- US stocks close with gains. Gains of greater than 2% for the major indices.

- Fed's Barkin: Fed will do what it takes to reduce inflation

- WTI crude oil settles at $109.52

- Bonds settle in but USD/JPY continues to hit new highs

- Decision on gas tax holiday by the end of the week - White House

- USD is expensive but is not yet a sell; scope for another 3% rally - Barclays

- Target CEO: There is a tremendous amount of uncertainty in consumers

- Bitcoin ticks above its 200 hour MA. Buyers make a play.

- European equity close: Nice bounce but gave a bit back in the latter half

- Fed's Barkin: After Michigan survey, I felt it was possible to do 75 bps

- German economy minister sounds the alarm bells on reduced natural gas supply

- It's not just the Fed, action on US inflation action is coming on the political front too

- New Zealand GDT price index -1.3%

- US May existing home sales 5.41m vs 5.40m expected

- Canada new housing price index for May 0.5% vs. 0.3% last month

- Canada April retail sales +0.9% vs +0.8% expected

- The EUR is the strongest and the JPY is the weakest as the NA traders enter for the day

- It's funny how quickly fear turns to greed

- ForexLive European FX news wrap: USD/JPY looks to the next leg higher

The JPY continued it's slide vs all the major currencies as the BOJ remains the lone soldier amongst battalion of tightening (or soon to be tightening) central banks. The JPY was weaker by -1.09% (vs the NZD) to -1.61% (vs the CAD). The AUDJPY also fell -1.45% on the day. The strongest currency today was the CAD followed by the AUD.

The USDJPY continued its run higher reaching yet another near 24 year high at 136.67. The next target comes near a topside trend line on the hourly chart at 136.93. Above that is the swing hi going back to September 21, 1998 which peaked at 137.23. Breaking above those levels increases the bullish bias even more (for a technical look at the USDJPY, click here).

Apart from the USDJPY which is closing near the highs and the USDCAD which is near the low, the other currency pairs vs the USD were up and down. THe NZDUSD and USDCHF were near unchanged on the day.

Taking a look at some of the specific pairs:

- EURUSD: The EURUSD based off the 200 hour moving average in the Asian session and moved up above its 50% retracement from the May 30 high at 1.0572. However momentum could not be sustained and the price moved back down toward the 38.2% retracement of the same move higher at 1.05215. The price is settling near 1.0531. On the downside in the new trading day, the rising 100 hour moving average comes in at 1.0503, while the 200 hour moving average (moving lower) at 1.0498. It would take a move below those levels to increase the bearish bias. Having said that, the buyers have not been too convincing either. The 1.0543 level was near highs from yesterday and also near a high in the Asian session today. In the North American session that level was broken leading to further selling. Get above 1.0543 in the new trading day and we should see higher prices.

- GBPUSD: The GBPUSD him also moved above its 50% midpoint of the recent move down (from May 27 high). That level comes in at 1.22995, but like the EURUSD, momentum could not be sustained and the price rotated back to the downside. The 100 hour moving average at 1.2244 and the 200 hour moving average 1.2233 will be support into the new trading day. The current price is trading at 1.22766. On the topside getting above the 50% at 1.22995 should increase the bullish bias if the level can remain broken.

- USDCAD: The USDCAD moved lower in the Asian session and in doing so fell below its 100 hour moving average (currently at 1.2958). On the downside, the rising 200 hour moving average 1.28988 is the next downside target. The current prices trading at 1.2915. The price is down for the 2nd consecutive day after topping out on Friday near the high price from May (double top near 1.3078). The question going forward is can the price move and stay below the aforementioned 200 hour moving average. If so, there should be further downside momentum with 1.28637 as the next target.

- AUDUSD: For the AUDUSD, its 200 hour MA had caught up to its 100 hour MA at 0.6980. That area will be the barometer for buyers and seller in the new trading day. Stay below (it is currently at 0.6969), and the sellers are more in control. Move above, and the technical bias shifts to the upside.

- NZDUSD: The NZDUSDs 100 hour MA broke above its falling 200 hour MA today (100 at 0.6322 and 200 at 0.63125). The current price is above both at 0.6328. In the new trading day, the MAs will be the barometer for buyers and sellers. Stay above is more bullish. Move below would be more bearish.

From the Fed today, Fed's Barkin said it was the Michigan Sentiment index that pushed him toward the 75 basis point hike. He also reiterated the newest mantra for the Fed.... "We will do whatever it takes to stop inflation". The problem is, does the price hike seen recently for things like cars ever come back down?

Pres. Biden will make a decision on the gas tax holiday by the end of the week.

US stocks got off to a good start in the holiday shortened week with gains of 2.15% or more for the 3 major indices (the NASDAQ led with a 2.51% gain).

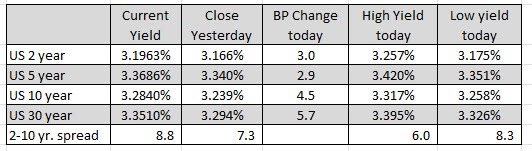

In the US debt market yields were higher across the board.

In other markets

- spot gold fell $6.17 or -0.34% to $1832.10

- Spot silver rose 9.7 cents or 0.45% to $21.68

- crude oil rose $1.74 or 1.61% $109.73

- Bitcoin rebounded above the $21,000 level today to $21,708.76, but is currently trading at $20,872.13