- Will the Fed end the taper early?

- EUR/USD 'prefect storm' likely to pass - Credit Agricole

- U.S. Treasury sells $20 billion of 20 year notes at a high yield of 2.210%

- Crude oil continues it's race to the upside

- European major indices closed mostly higher. The exception is Italy.

- Atlanta Fed GDPNow estimate ticks up to 5.1% from 5.0% last

- Gold rises to the highest since November

- Beijing records 5 new local covid infections. Mass disinfection of mail begins

- BOE's Bailey: The labor market is very tight

- US December building permits 1.873M versus 1.71M estimate

- Canada December CPI +4.8% y/y vs +4.8% expected

- The AUD is the strongest and the USD is the weakest as NA traders enter for the day

- UK PM Johnson calls for stop to "Plan B" COVID-19 restrictions

Looking at the markets today

- Gold down up $28.70 or 1.59% at $1842.05

- Spot silver is up $0.72 or 3.02% at $24.16

- WTI crude oil (February) is trading at $86.61.

- Bitcoin is trading fairly steady $41,690

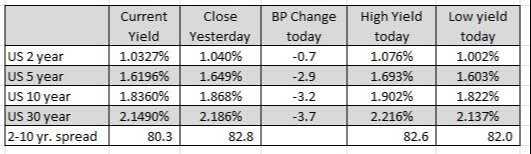

US yields moved lower today with the 10 year down -3.2 basis points and the 30 year down -3.7 basis points, but that did not stop stocks from also moving lower and

closing at the lows.

Looking at the yield curve, the 2– 10 year spread narrowed to 80.3 basis points from 82.8 basis points yesterday. The US treasury successfully auctioned off 20 billion of 20 year notes at 2.21%. That was 1.5 basis points below the WI level at the time of the auction. Strong investor demand from over seas highlighted the breakdown of the results.

The lower yields and strong auction did not help US equities . In the US stock market, the S&P and NASDAQ are lower for the second consecutive day while the Dow industrial average is down for the third consecutive day. Moreover, each of the major indices closed further away from key daily moving averages. For the S&P and Dow, the indices are closing below their 100 day moving averages. For the NASDAQ index, it is closing below its 200 day moving average for the second consecutive day. The NASDAQ index as not closed two consecutive days below its 200 day moving average since early April 2020. All the closes are bearish tilts for each of those indices.

Looking at the major indices all lower closing near their lows:

- Dow industrial average fell -339.82 points or -0.96% at 35028.64

- S&P index fell -44.32 points or -0.97% at 4532.70

- NASDAQ index felt -166.63 points or -1.15% at 14340.27

- Russell 2000 felt -33.44 points or -1.6% at 2062.78

The economic calendar was light today in the US with building permits and housing starts for December the only economic release. Both building permits and housing starts were near recent cycle highs as supply still remains out of whack versus demand (in favor of the sellers) despite the run up in prices and yields (at least in December).

In Canada, CPI year and year came in at 4.8% which was the highest since 1991. However, the month-to-month figure was down -0.1% which was the first decline since December 2020

Crude oil continued its run to the upside with the February contract trading trading up to $87.90, a new high going back seven years. However, it is trading nearer the lows at $86.45. The low reached $85.78 today

In the forex, the AUD and NZD are the strongest of the majors, while the USD is ending the weakest. That sort of makes sense looking at the US rates moves today, but the equity decline does not necessarily jive with the "risk on" theme in the forex (normally).

The AUDUSD moved up in the London morning session and in doing so extended above its 200 and 100 hour moving averages. However into the close, the price is moving back below those moving averages at 0.7218 (they are converged). The level will be a key barometer for buyers and sellers into the new trading day.

The EURUSD moved marginally higher after three days of declines. The low to high trading range was only 32 pips coming into the trading day. It is ending at 38 pips indicative of the lack of price action.

The USDJPY traded below the 100 hour moving average in the Asian session, then moved above in the London session, only to move back below in the US session. That moving average comes in at 114.357. The price is trading at 114.29 going into the close. The double bottom low for the day came in at 114.203. If the price can get below that level, there to be further downside probing away from the 100 hour MA.

The GBPUSD meanwhile moved higher help by CPI inflation that was at a 30 year high. Although the price moved above the 200 hour MA intraday on the rise, it found sellers back below that MA At 1.3641) into the close. It would take a move above that MA and the higher 100 hour MA at 1.36519, to increase the bearish bias.