- S&P runs away from 100D MA. Bullish. Nasdaq tests 100D MA and backs off. Resistance holds

- Pentagon: There has been some movement by small number of Russian forces away from Kyiv

- WTI crude oil futures settle at $104.24

- Yield curve inversion dominates the discussion

- Energy is setting up to be the trade of the decade

- U.S. Treasury auctioned off at $47 billion of 7 year notes at a high yield of 2.499%

- US 2– 10 year spread narrows to about 2 basis points

- US Senate votes to move Fed nominee Lisa Cook to a confirmation vote

- SNB's Zurbruegg: It is not roll of monetary policy to cure risks to financial system

- European major indices closed with solid gains

- More from Harker: Would not take 50BP hikes off the table but not committed either

- Russia's top negotiator says de-escalation around Kyiv/Chernihiv does not mean cease-fire

- Philadelphia Fed president Harker: interest rate hikes to be deliberate, methodical

- Dallas Fed services revenue index for March 23.4 versus 21.9 last month

- JOLTs US job openings for February 11.27M vs 11.0M estimate

- US March consumer confidence index 107.2 vs 107.0 expected

- Case-Shiller January US 20-city home price index +19.1% y/y vs +18.6% prior

- ECB's Lane: We think that inflation will decline this year and be much lowr next year

- Oil plunges through $100 on hopes for peace in Ukraine

- ECB's Holzmann: Raising rates to zero by 2022 is critical for ECB policy

- Canadian January average weekly earnings +2.5% y/y vs +1.74% prior

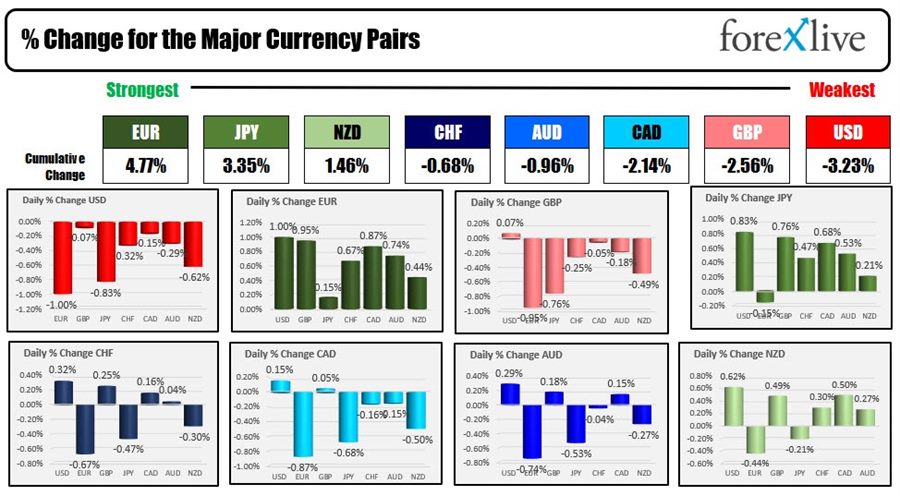

- The EUR is the strongest and the CHF is the weakest as NA traders enter for the day

- ForexLive European FX news wrap: Russia, Ukraine make some progress in Istanbul

The spread between the 10 year yield and the 2 year yield reached it's most narrow September 2019. The spread moved to around 2 basis points and just above the the inverted level.

The inverting of the spread is thought to prelude a recession. There is correlation to the inversion and recessions, but it does not always work. Moreover the lag time can vary. Nevertheless, the inversion is worthy of headline news.

Today the 2 year yield is up about 3.9 basis points at 2.371%, while the 10 year yield is down -6.6 basis points at 2.396%.

The threat of the inversion did not deter the US stock indices from running higher. The gains were help by hopes for a Russian/Ukraine cease-fire sooner rather than later. Russian officials said that there was progress made in talks with Ukrainian officials although there are no scheduled new meetings.

Economic data today showed that Case Shiller home sales continue to show a strong gains year on year. The 20 city price index rose 19.1% versus 18.6% prior.

Also released today was March consumer confidence which came in better than expected 107.2 versus 107.0. The present situation index rose to 153.0 from 145.0, but the expectations tumbled to 76.6 from a revised 80.8 last month (was 87.5). The one year inflation is also up sharply to 7.9% versus a 7.0% last month.

Both the Dow and the S&P rose for the 4th consecutive day. The Nasdaq rose for the 2nd consecutive day, but rose for the 8th time in 11 days and is up 16.4% from the March 14 low. In contrast, the S&P is now up 12.56% from its February 24 cycle low while the Dow is up 9.3% from it's February 24 low.

Technically, the S&P closed above its 100 day MA for the 2nd consecutive day (100 day MA at 4545.81). The Dow closed above it's 100 day MA for the 1st time since February 9th (at 35090.27). The Nasdaq, meanwhile tested but backed of from it's 100 day MA at 14648.84 (high reached 14646.90).

Below are the highs and lows and closes and % numbers for the major US and European stock indices today (the European stock indices were all solidly higher):

In the forex market, the EUR is the strongest of the majors as it benefits from hopes of ceasefire. The USD is the weakest of the majors. The GBP followed the EUR higher but gave up gains and is lower vs all the major currencies with the exception of the USD.

Technically:

- EURUSD: The EURUSD moved sharply higher as the pair broke higher in European trading on hopes of a cease fire sooner than later. The price moved up to test the high from March 17 at 1.11369. The high today reached 1.11365, and backed off. The NY session low moved back down to test the swing highs from March 18 and March 21 near 1.1070 and found support buyers. A move below that level in the new session would be needed to disappoint the buyers today. Conversely, with a double top at 1.1136 now, the importance of getting above that level increases.

- GBPUSD: The GBPUSD followed the EURUSD higher in the European session but ran into resistance against the falling 100 hour MA (the price got within a few pips of that MA at the time). The subsequent move back to the downside saw the pair erase the gains and close near unchanged. The 100 hour MA at 1.31534 (and moving lower) remains the upside hurdle followed by the falling 200 hour MA at 1.3169. On the downside falling below 1.3050 (low for the day) would be more bearish.

- USDJPY: The USDJPY dipped below the 100 hour MA for the first times since March 7, but could not sustain downside momentum. The 100 hour MA comes in at 122.515 and moving higher. That level will be eyed in the new trading day as a short term barometer (current price is at 122.86) Stay above and all is still bullish. Move back below and the technical picture can deteriorate if the price stays below the level.

In other markets near the 5 PM NY close:

- Spot gold is erased sharp declines and is down around -$3.00 an trading at $1919.17

- WTI crude oil futures had a wild up and down session settling at $104.24 after trading as low as $98.44. The current price is trading at $105.32 which is down around $0.65 or -0.62% on the day

- Bitcoin is trading at $47,385 after trading as high as $48,128.87