- US major indices close the day with mixed results

- Can it really be? Earnings calendar starts next week

- Crude oil futures settle at $104.79

- US May consumer credit outstanding +22.35B vs +31.9B expected

- The post-mortem on the $800 billion US Paycheck Protection Program is damning

- Baker Hughes oil rig count up 2 to 597

- Feds Williams: Debate of 50-75 bps is right position for July meeting

- European indices close mostly higher on the day and for the week

- Steep outflows could trigger a substantial downside for gold in coming sessions - TD

- Fed's Williams: We must be resolute on inflation, we cannot fall short

- Fed's Brainard: Crypto platforms are highly vulnerable to deleveraging and fire sales

- US wholesale inventories +1.8% vs +2.0% expected

- Fed's Bostic: Economy is starting to slow and that's what we need

- Canada June employment change -43.2K vs 23.5K estimate

- US June non-farm payrolls +372K vs +268K expected

- The JPY is the strongest and the CHF is the weakest as the NA session begins

- Abe put on a master-class in diplomacy by courting Trump

- US and Canadian jobs reports highlight the economic calendar

- Forexlive European FX news wrap 8 Jul

The US jobs report added 372K new jobs in June. That was higher than the 268K estimate. Admittedly, there was a revision of -74K over the last two months (with May revised to 384K from 390K). Nevertheless, if the current month was adjusted for that number, a net addition of 298K (372K - 74K revision) still beats the consensus estimate.

Looking at the other measures within the report, the unemployment rate remained steady at 3.6%. Average hourly earnings rose 0.3% as expected and rose 5.1% vs 5.0% estimate. The participation rate fell to 62.2% vs 62.3% estimate. The U6 underemployment rate came in at 6.7% vs 7.1% estimate.

Overall, the jobs report - barring a huge surprise in the CPI next week which is expected to show 1.1% gain MoM and 0.6% for the core - is likely to lead to another 75 basis point hike by the Fed when their interest rate decision is announced on July 27. That would take the target range to 2.25% to 2.5% which Fed officials called the neutral rate. The expectations are for the path of rate rises to continue into the year end. The Fed's central tendencies saw the rate at the end of year at 3.4%, which implies an end of year target rate of 3.25% to 3.5%. That sounds about right.

The questions at that point is "What comes after that?"

- Can the Fed execute the soft landing?

- What happens to other rates like mortgage rates and to the housing market?

- Does the Fed indeed avert a recession?

- If not, does the Fed move back down toward neutral?

- How does the stock market react?

- Has the market gone too far with the bearishness

This week, the major stock indices moved higher with the Nasdaq outperforming with a 4.5% gain. The ARK Innovation fund rose 13.68%. Admittedly it is down -70.66% from it's high, but is there roam to roam from lower levels. 10% on the current price of $46.86 is $4.68. Getting to $51 or $52 is not a hard hurdle considering the high in 2021 was up at $159.70 and the price traded at that level on April 25th - not so long ago.

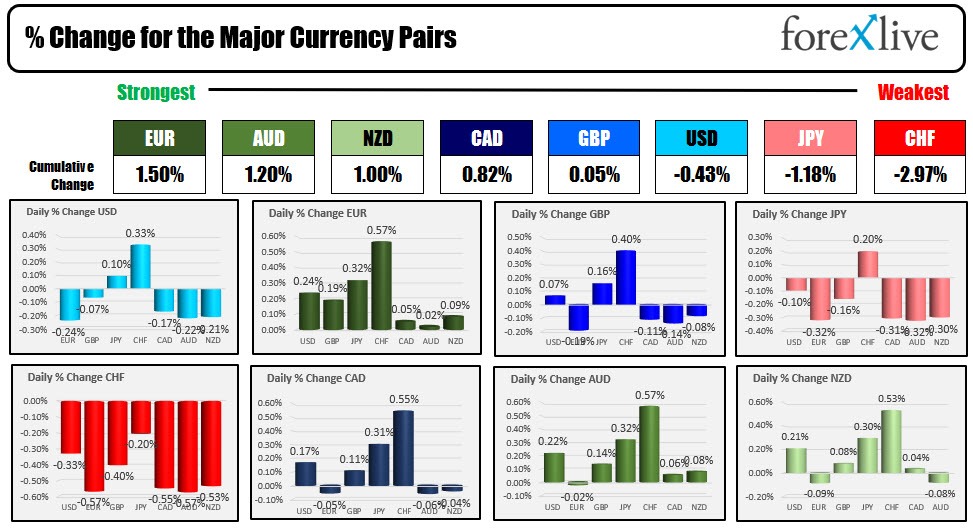

In the forex market today, the USD was mixed with gains vs the JPY and CHF and declines vs the EUR, CAD, AUD and NZD. The greenback was little changed vs the GBP. The price action in the forex saw up and down volatility. The dollar moved higher after the jobs report, but then started to give up those gains into the London close. After London traders exited, there was a modest move back higher, but overall the changes on the day were relatively modest with a 0.33% gain vs the CHF and a -0.24 decline vs the EUR the biggest movers.

Overall, the EUR was the strongest of the majors and the CHF was the weakest. The EURCHF was the biggest currency pair mover with a 0.57% gain on the day. Relatively speaking the changes were modest as traders ponder what may have already been priced in.

Nevertheless, it is hard to see a sharp move lower in the dollar going forward given the green light for the Fed to raise rates from both job gains and inflation, while Japan and the EU are still struggling with the idea of tightening, and the UK has political, inflation and European issues to contend with as well.

Next week, the Bank of Canada and the Reserve Bank of New Zealand are still expected to raise their rates by 50 basis points respectively (both announce on Wednesday).

In Canada today, their jobs report was weaker than expected with a decline of -43.2K jobs vs expectations of +23.5K (most in part time jobs at -39.1K and in the service sector). However, the unemployment rate declined to a new record low at 4.9% vs 5.1% estimate as the participation rate fell to 64.9% vs 65.3% with workers leaving the workforce.

In other markets today:

- Spot gold rose $1.98 or 0.11% to $1742.10. Last Friday, the price closed a $1810

- Spot silver rose $0.10 or 0.55% at $1931. Last Friday, the price closed at $19.87

- Crude oil is at $104.78 up $2.08 on the day. The close last week was at $108.42

- Bitcoin is trading at $21864. The price a week ago today was at $19239

In the US debt market today, yields moved sharply higher as it seems 75 basis points is baked in the cake now

- 2 year yield 3.105%, up 9.7 basis points on the day. The yield last Friday closed the week at 2.839% for a week gain of over 26 basis points

- 5 year yield 3.127% up 9.0 basis points on the day. The yield a week ago was at 2.884% for a gain of around 25 basis points for the week.

- 10 year yield 3.082% up 8.2 basis points on the day. The yield a week ago was at 2.889% for a gain of 19 basis points for the week.

- 30 year yield 3.252%, up 6.3 basis points on the day. The yield a week ago was at 3.116% for a gain of around 14 basis points for the week.

Sad notes this week included the killing of seven in Highland Park, Illinois during a 4th of July celebration parade include the mother and father of a 2-year child, and the assassination of former Japan PM Shinzo Abe while he addressed a crowd. during an election campaign rally in Nara, Japan. In the US gun violence is as common as the sun rising, but in Japan it is rare.

It is easy to become numb and complacent to violence. However, at the end of each bullet there are people with stories and incomplete lives and children and families and sometimes even nations that are denied what they could have done tomorrow, next week, next year and beyond. It is a tragedy that should not happen.

Let's hope the pendulum starts to swing the other way, at some point and that time is soon. In the meantime, say a prayer for peace and for all the victims who happened to be at the end of a bullets path of destruction.