- Biden to visit Saudi Arabia this month and meet the crown prince

- Major indices erase the week's declines. Now up on the week.

- Gold moves sharply higher and tests swing high from May 24

- WTI crude oil futures settle at $116.87

- More Mester: We cannot say today how high interest rates will need to go

- Fed's Mester: Do need ongoing rate increases including 2x 50 BPs at the next two meetings

- Even more from Beaudry: Thinks can get out inflationary cycle without going into recession

- New York Fed's Logan: Central bank digital currency could lead to larger balance sheets

- US commerce Sec. Raimondo: Seeing improvement with declining port congestion

- European major indices close higher

- More from BOC Beaudry: Will probably have to raise rates to top of neutral range/above it

- Crude oil inventories see a draw of -5.068M vs -1.35M estimate

- Bank of Canada's Beaudry: Likely that BOC may need to raise policy rate to 3% or higher

- Fed's Brainard sees room for margins to compress and for businesses to bring down markups

- US April factory orders +0.3% vs +0.7% expected

- OPEC+ agrees to raise output by 648K in July and August - report

- Microsoft lowers there guidance on unfavorable forex impact

- JMMC recommends 650K increase in OPEC+ production for July - report

- US Q1 unit labor costs +12.6% vs +11.6% expected

- US initial jobless claims 200K vs. 210K estimate

- Canada April building permits -0.6% vs +0.7% expected

- ADP May US employment +128K vs +300K expected

- The GBP is the strongest and the USD is the weakest as NA traders enter for the day

- ForexLive European FX news wrap: Dollar checked back lower, risk steadies

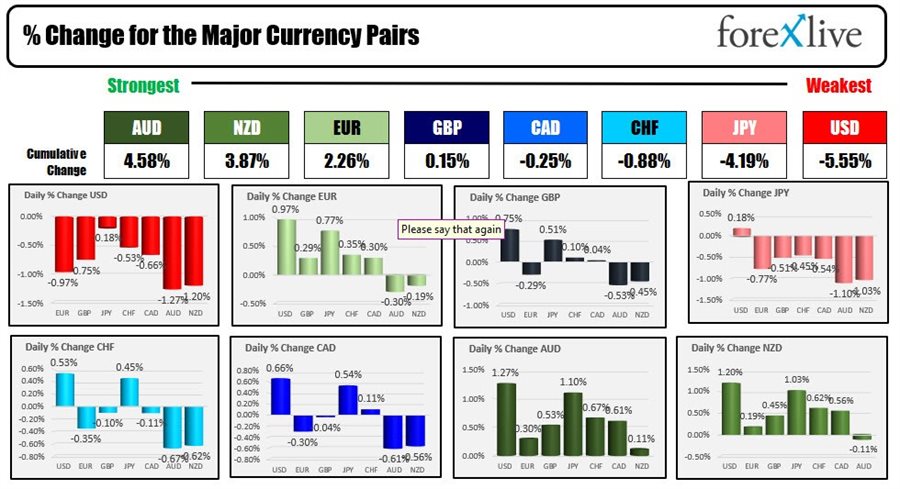

With the always important US jobs report less than 16 hours away, the markets headed into full on, risk-on. Not only did the US stocks move sharply higher and close at the highs, but the AUD and NZD led the table as the strongest of the majors, while the flow of funds headed out of the "safe haven" USD and the JPY. Below are the ranking of the strongest to the weakest of the major currencies today

Meanwhile looking at the US stocks, they did trade lower with the Dow down -0.93%, the S&P down -0.65% and the Nasdaq down -0.78% at session lows, but recovered and closed with solid gains of 1.33%, 1.86% and 2.72% respectively. Moreover, the indices went out at the highs.

Those gains came despite some hawkish comments from Fed's Brainard who would not bite when asked if a pause might be in order in September after 2x50 basis point hikes. Her response admittedly was along the lines that there is a lot of data before then, but she also added that

"If we don't see a deceleration in monthly inflation prints, then it might well be appropriate to have another 50 bps hike".

So she erred on the side of "I would be ready for another 50 basis points" if needed.

Later Fed's Mester reiterated what is increasingly the party line, that inflation is the biggest enemy for the Fed now, and they will do all they can to suppress it.

ON the data front today, the preview to the non farm payroll - the ADP jobs report - came in weaker than expected at 128K vs 300K estimate. US factory orders were also weaker at 0.3% vs 0.8% estimate.

Why the rally in stocks and flow into risk on if data was weaker than expected and Fed officials are "more hawkish"?

The markets seem to be taking the word of the Fed officials that they are news and data dependent, BUT, they will still tighten into the weakness to insure inflation does indeed move lower.

As a result, if the data is weak and continues to weaken, the Fed will still move rates to neutral and perhaps even a little above. However, inflation is more likely to decline, the US may avoid going into a recession and a finish line for the worst case scenario starts to come more into focus (stocks rally while the Fed tightens to neutral).

Conversely, if the data is strong, that is bad for inflation, it will push the Fed toward higher rates and perhaps at an even faster pace.

Hence, the reaction today. As long as the data is not stronger but weaker, the market can ignore what we already know about the Fed, and look forward to a finish line.

That brings us to the employment data tomorrow.

I would expect if the number is weaker (like ADP today), with hourly earnings behaved (0.3%), we will continue to see price action similar to today's moves (dollar lower, stocks higher, rates more steady-ish).

Alternatively, if the data is stronger and earnings are not under control, watch out below. Rates will soar, stocks will sour and the dollar will move higher.

PS Also of interest today is that Microsoft - before the open (a major bellweather global company) - guided estimates for revenue and earnings lower on the back of foreign exchange (i.e. dollar strength).

Currencies like the USDJPY moved to 20 year highs this year and that is a major brake to overseas profits.

As a result of that explicit action, a higher dollar may carry a little more bearishness into the stock prices going forward as the markets assume that if the higher dollar is bad for Microsoft, it will be just as bad for ALL global corporations (especially the big cap ones like Alphabet, Amazon, Apple, etc.). The longer the dollar stays higher, the more risk for earnings to start being ratcheted down as a result.

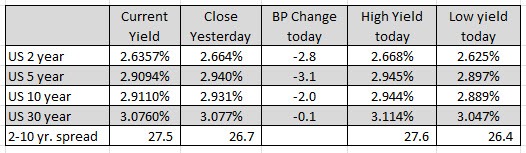

IN the US debt market today, the rates moved lower and closed near lows.

In other markets:

- Spot gold moved higher on the decline in the dollar. The price is closing up about $22.41 or 1.21% at $1868.39

- Spot silver is also higher by $0.48 or 2.1% at $22.28

- Crude oil had a volatile down and up day. Early in the NY session it was reported that OPEC+ would raise production by close to 650K vs 430K expectations. That sent the price to the low near $111.20. Later the inventory data showed a much larger than expected drawdown of inventories that helped to push the price back higher. The price is at $117.38, up $2.12 or 1.84% on the day

- Bitcoin traded above and below $30000 and is trading at $30233 near the NY session 5 pm close.

Good fortune with your trading.