The major US stock indices are trading modestly lower at the start of trading for the day. The Dow industrial average is trading above and below unchanged. The NASDAQ index is leading the way to the downside with a somewhat modest -0.35% decline. The major indices all fell yesterday after the Federal Reserve raised rates by 75 basis points and indicated that rates at the end of the year would be higher than the markets expectations.

A snapshot of the market 4 minutes after the opening bell is showing:

- Dow industrial average -6.76 points or -0.02% at 30177.03

- S&P index -4.77 points or -0.13% at 3785.17

- NASDAQ index -29.64 points or -0.26% at 11190.56

- Russell 2000-5.77 points at -0.33% 1756.38

In the US debt market,

- 2 year yield is back above the 4% at 4.097%

- The 10 year yield has reached a new high going back to February 2011 at 3.654%. The next target comes in at 3.75%.

In other markets:

- spot gold is trading up $4.08 or 0.29% $1677.60

- Silver is up $0.09 or 0.5% $19.64

- WTI crude oil for November is trading at $85.79 up 3.39%

- Bitcoin is trading at $19,059

In the European equity markets:

- UK FTSE is down -0.15%

- German DAX is down -1.0%

- France's CAC is down -0.93%

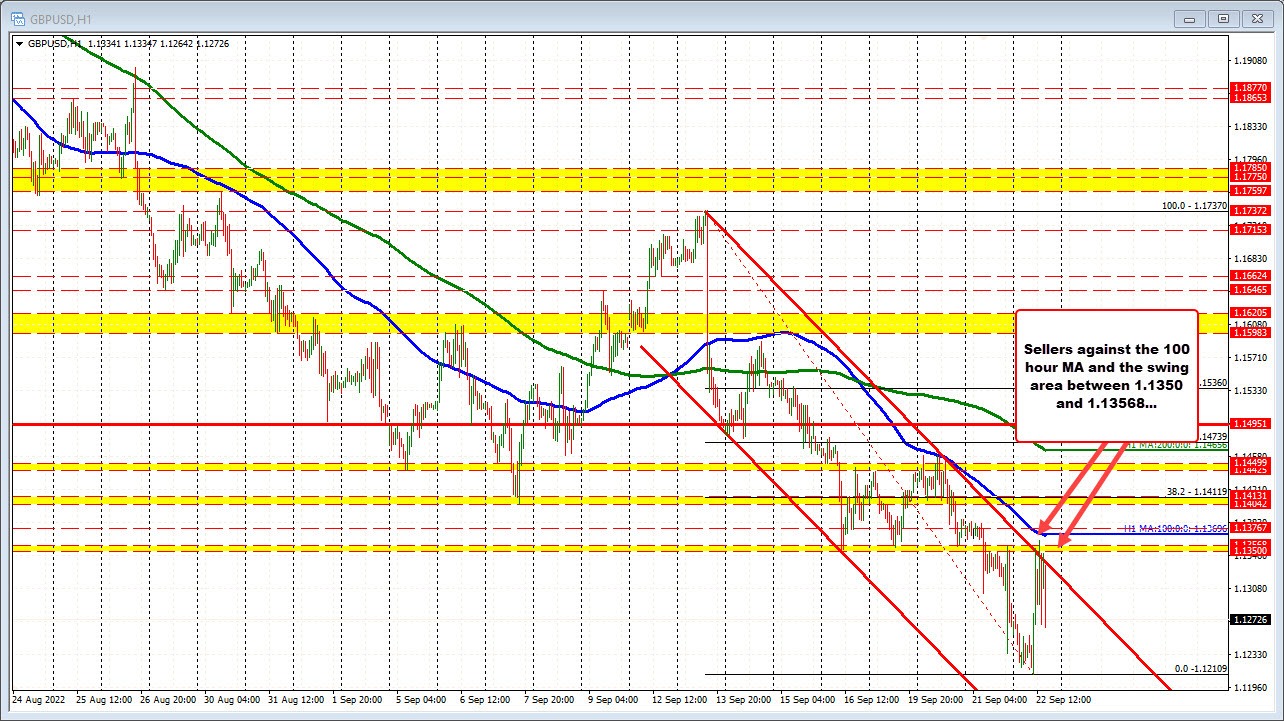

The USD has started to move back to the upside. The GBPUSD - after moving higher ahead of the BOE decision and retesting key swing area between 1.1350 and 1.13568 and the falling 100 hour moving average 1.13696 (see blue line in the chart below) - found willing sellers against the resistance targets, and has resumed its downward bias. The pair trades at 1.12596 currently. Sellers remain in control below the aforementioned resistance levels.