This was a slow week as the market is probably waiting for the next week’s US CPI report and the FOMC meeting. Nevertheless, we got some interesting developments on the macro side with big misses in a couple of US tier one data points, two surprising rate hikes and Eurozone entering a technical recession after revision to the previous data.

The NFP report last Friday beat once again expectations on the headline number for the 14th consecutive time. Looking at the other parts of the report though doesn’t give the same vibes. The unemployment rate jumped from 3.4% to 3.7%, which is the largest M/M increase since covid. The average weekly hours ticked lower, and the average hourly earnings came out on the soft side. Now, there’s something for everyone here.

One side may see the higher unemployment rate as possible noise or less market tightness. The lower average weekly hours can be seen as just returning to the pre-pandemic trend and the lower average hourly earnings as good news for lower wage inflation. The other side, on the other hand, may ignore the headline number and focus more on the trend given the current context. There should be noted that generally employers cut back on hours before cutting back on employees.

The week started with the news that Saudi Arabia decided to make an additional voluntary cut by 1 million bpd in July and signalled that it could be extended. This may not be such a big surprise given that the Saudi Oil Minister just a couple of weeks ago warned the speculators to watch out and that they will be ouching.

Moreover, the other OPEC+ members will extend the cuts through 2024, while previously they were supposed to reevaluate at the end of 2023. WTI Crude Oil opened with a positive gap at the $75 level but it was quickly filled during the APAC Session.

In the short-term, this decision may be bullish for oil prices and if it wasn’t for the cut, we might have seen oil falling faster. We have already seen with the last surprising cut that in a contractionary cycle, the demand side weakness can weigh significantly on oil prices. For some context, below you can see the correlation between WTI Crude Oil, the USD Index (inverted) and the ISM Manufacturing PMI generally leading the other two.

The Switzerland Headline CPI came at 2.2% Y/Y and the Core measure at 1.9% Y/Y. The SNB inflation target is just below 2%, so the central bank may pause at its June meeting and, even if it hikes, it may be the last one for this cycle. Later in the week SNB’s Jordan’s comments boosted the Swiss Franc as he delivered some hawkish remarks about inflation being more persistent than they thought and that it’s not a good idea to wait for inflation to rise and then being forced to hike even more.

The US ISM Services PMI came in at 50.3 vs 52.2 expected, barely missing the contractionary territory. The employment sub-index fell into contraction at 49.2 vs 50.8 prior and prices paid fell to 56.2 vs. 59.6 prior, which is the lowest reading since May 2020. This should be good news for core inflation if the trend continues.

The RBA surprised with another 25 bps hike raising the cash rate to 4.10% citing inflation risks skewed to the upside given the tightness in the labour market and wage growth. The central bank has also suggested that “further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”. High inflation for too long increases the risk of expectations getting de-anchored.

The recent hawkish repricing in the markets for more Fed hikes weighed on Bitcoin as it has become a risk asset since wider adoption made it to correlate with more traditional markets. Recently, those hawkish expectations started to ebb given more disappointing economic data, but this week it’s the SEC that weighed on Bitcoin.

In fact, the U.S. Securities and Exchange Commission (SEC) sued on Monday Binance, the largest cryptocurrency exchange in the world, and Chairman Zhao for mishandling customer funds, lying to regulators, and misleading investors about its operational safeguards. The next day, the SEC sued Coinbase for operating as an unregistered broker. Nonetheless, Bitcoin rallied hard probably on expectations that more regulation would strengthen the cryptocurrency market, or it was just a technical bounce.

The BoC surprised with a 25 bps hike bringing the overnight rate to 4.75% as the Canada’s economy was stronger than expected in the first quarter of 2023 and inflation remained stubbornly high. Given the tight labour market, the central bank sees the risk of inflation getting stuck much above the 2% target.

This is basically the same reason that pushed the RBA to restart hiking as high inflation for too long increases the risks of inflation expectations getting de-anchored and requiring a much more painful process to return to target. As a final note, the BoC removed from the statement the line “remains prepared to raise the policy rate further if needed to return inflation to the 2% target". It may be a one and done or they just didn’t want the markets to price in another hike at the next meeting.

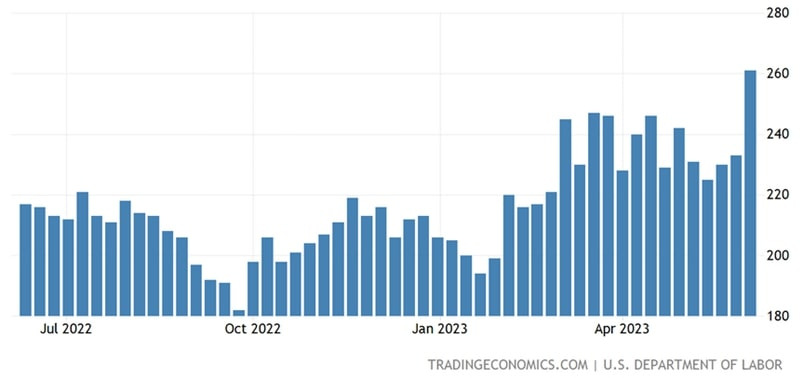

The US Jobless Claims jumped to 261K vs. 235K expected in the biggest weekly increase in almost two years. Continuing Claims, which are an indicator of how hard it is for people to find work after losing their jobs, improved further to 1757K vs. 1794K prior although it lags initial claims by a week. It might be just noise, but coupled with the weaker details in the NFP report it makes you wonder about the beginning of more softness to come for the labour market.

China’s inflation data disappointed again coming at 0.2% vs. 0.3% expected for the Y/Y reading. The PPI Y/Y has also slipped further into deflation at -4.6% vs. -3.6% prior. Given the weak domestic demand and the risk of deflation, there are growing expectations that we could see interest rates cuts, possibly even at the next week’s PBOC meeting. This may weigh even more on the yuan but boost the stock market.

The Canadian employment report missed expectations across the board with the employment change coming at -17.3K vs. 23.2K expected and the unemployment rate at 5.2% vs. 5.1% expected.

Next week should be better with the US CPI, FOMC, ECB, Jobless Claims and University of Michigan survey being the highlights. That's all folks. Have a great weekend!