The UK finance minister Kwerteng on the BBC is saying:

- His economic strategy is not a gamble

- Did not acknowledge that the UK was in recession and that one was not inevitable

The GBPUSD and rates might say otherwise.

UK 10 year yields rose to a high of 3.842% which was the highest level since May 2010.

The currency traders pounded the pound to the downside.

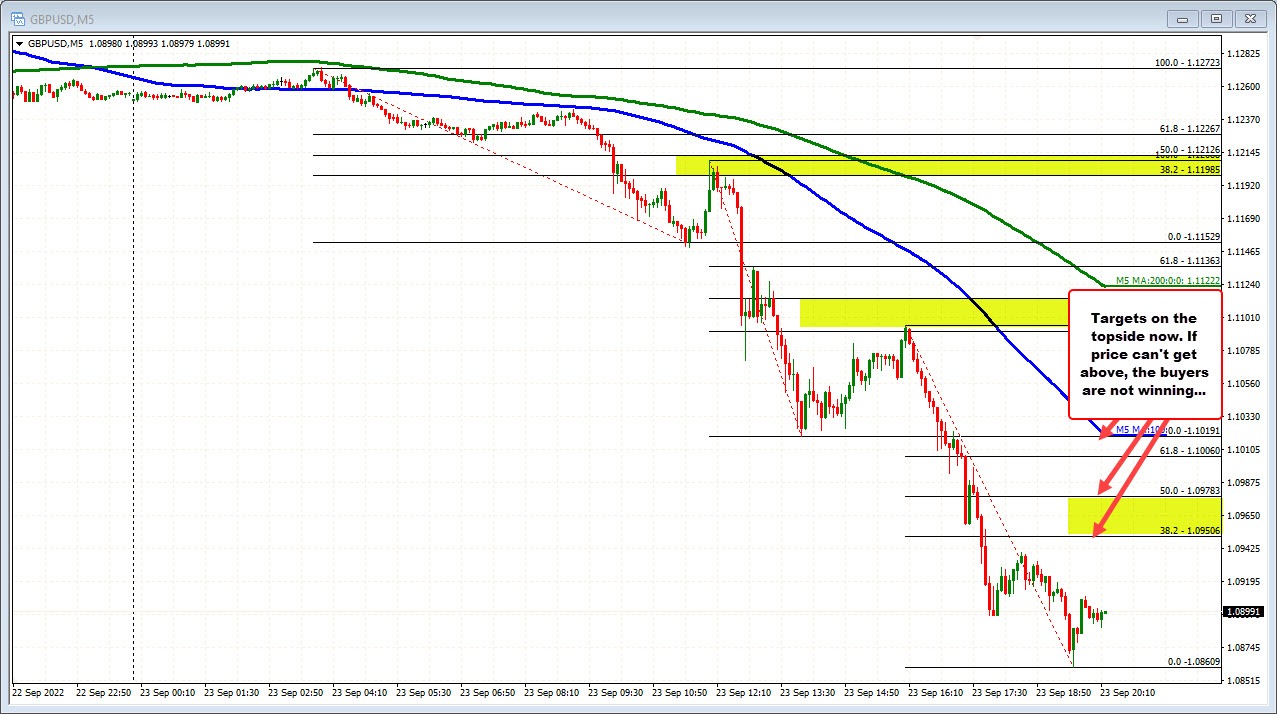

Looking at the 5 minute chart below of the GBPUSD, the pair reached a new session low at 1.08609 and lowest level since 1985. The move to the downside has been in 3 trend leg moves with the last move being the longest and the sharpest decline. It took the price from 1.10957 to 1.08609 or -235 pips.

The 38.2% – 50% correction zone comes in between 1.0950 and 1.09783. Getting above at level would give dip buyers some comfort and a small victory at least intraday. The falling 100 hour moving average at 1.1023 would be another target to get to and through if the buyers are to start winning in the short-term .