For the past few months there's been an unambiguous trend in markets where bad news was seen as good news because it meant a cap on Fed rates. We're coming to the end of that trend.

Instead, the market will grow increasingly concerned about a hard landing in the economy and will want to see evidence of resilience.

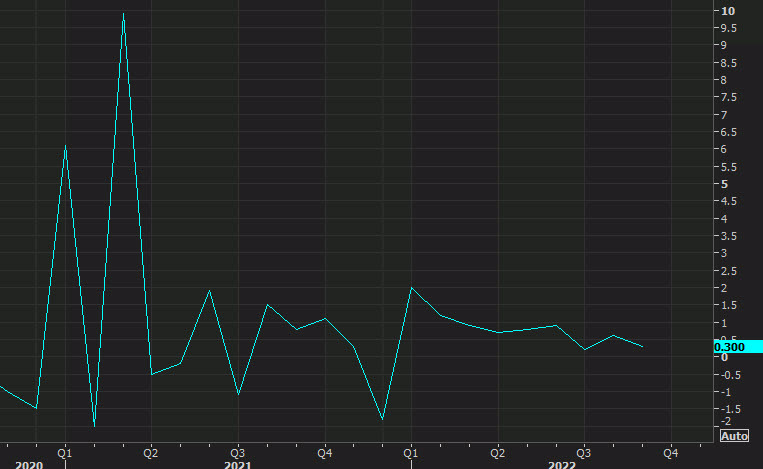

The cooler CPI report last week marks the beginning of that trend but it will take some time to fully materialize. A good test comes with today's US retail sales report at the bottom of the hour. The consensus is for sales to rise 1.0% and 0.2% excluding autos and gas.

I expect the market to continue to like soft sales so long as they're not too soft. In this case, I'd peg that a something worse than -0.2% on the ex-autos and gas metric.

The retail sales report is just one part of a busy day of economic data that includes:

- Canadian CPI

- US import/export prices

- US industrial production

- US business inventories

- US NAHB home builder index

- Weekly oil inventories

- Comments from the Fed's Williams

- 20-year auction

For more, see the economic calendar.