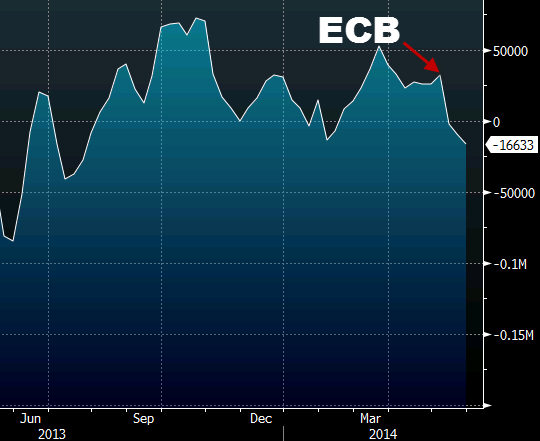

Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday, May 27 2014:

- EUR net short 17K vs short 9K prior

- JPY net short 59K vs short 54K prior

- GBP net long 35K vs long 33K prior

- AUD net long 16K vs long 19K prior

- CAD net short 22K vs short 26.5K prior

- CHF net short 4K vs long 5K prior

- NZD net long 18K vs long 18K prior

There has been a steady shift to euro shorts since the May ECB meeting, now it’s time for Draghi to deliver.

Euro net