German DAX surges by 5.2%, France CAC up 7.6%.

The major European indices are closing sharply higher. The gains are the 5th in the last 6 trading days. Spain's Ibex leads the way with a gain of over 8%.

The provisional closes are showing:

- German DAX, +5.2%

- France's CAC, +7.6%

- UK's FTSE 100, +4.9%

- Spain's Ibex, +8.6%

- Italy's FTSE MIB, +5.5%

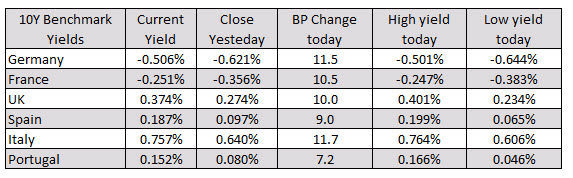

In the European debt market, yields were sharply higher as well as investors push up yields in reaction to a potential Covid vaccine (and rebounding economies).

In other markets:

- spot gold is trading down $97 or -4.98% $1854

- spot silver is trading down $1.95 or -7.61% at $23.63

- WTI crude oil futures are surging by $3.19 or 8.59% at $40.35

in the US stock market, shares are higher but off the highest levels for the day

- S&P index up 97.71 points or 2.78% at 3607. The high price reached 3645.99

- NASDAQ index is up 124.14 points or 1.05% 12019.59. It's high reached 12108.06

- Dow industrial average up 1093 points or 3.86% at 29415. It's high price reached 29933.83

In the forex, the CAD is the strongest followed closely by the NZD. The USD is higher from early New York trading levels. It is still lower vs. the commodity currencies including the CAD, NZD and AUD, but is up 2.15% vs. the JPY and 1.5% vs the CHF. The weakest currencies are the JPY and the CHF. They are getting hammered on risk on flows (and flows out of the relative safety of the JPY and CHF).

In the US debt market, yields are sharply higher with the yield curve steepening. The 2 – 10 year spread is up to 77.39 basis points from 66.58 basis points at the close of trading on Friday. The 10 year yield is up 13.4 basis points while the 30 year yield is up 14.4 basis points on the day.