Slowly....

The EURUSD is extending the gains for the day and in the process of the range for the day. At the start of the North American session, the trading range was around 22 pips. Since then, the price has extended to the upside in the ranges up to 38 pips. The average over the last 22 trading days is 51 pips.

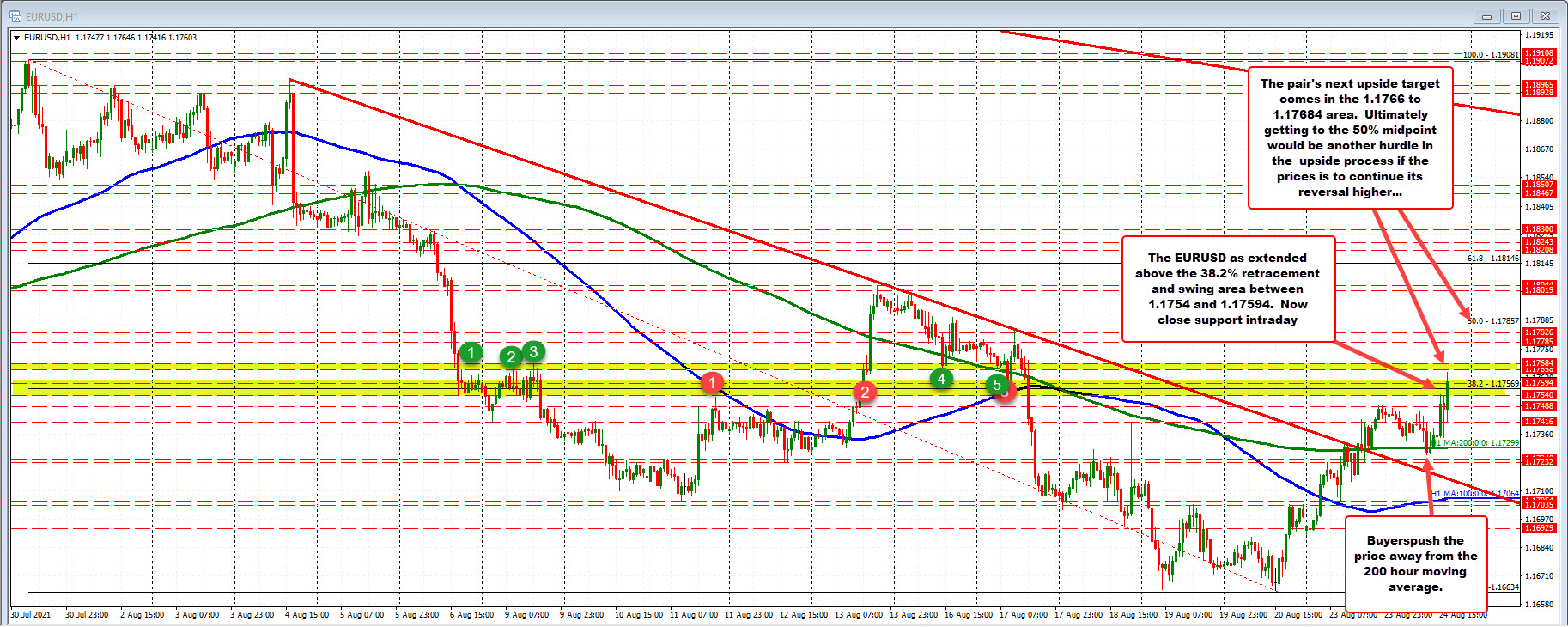

In the process, the price has moved above the 38.2% retracement of the move down from the July 30 swing high (that was the highest level since June 29). The 1.1754 to 1.17594 will now be eyed as close intraday support for intraday traders. Stay above keeps the buyers comfortable, and in control at least intraday.

The next upside target comes in between 1.17656 and 1.17684. Get above that, and traders will start to look toward the 50% retracement 1.17857 as another step in in the upside process.

Getting above the 200 hour moving average and 38.2% retracement are needed steps in a corrective process if the counter trend traders are to start to shift the bias more in their favor. It is a positive step, but just part of the process. Needless to say the price has been more on a downtrend since July 30. That too needs to be respected.

However, the low on Friday bottom near the low from Thursday (double bottom). The price moved above the 100 hour moving average (blue line in the chart above), retested that moving average before moving higher yesterday. The price moved above the 200 hour moving average (green line), and in trading today came down to retest that moving average moving average and found support buyers near that level.

So the buyers are doing their "ABCs". Can they keep it going with the break of the 38.2% retracement now?