Moved away from the 100 day MA

The price action for the EURUSD saw the high for the day test but stall at the 100 day MA (at 1.16504). On the downside, the price just moved to test the underside of a broken trend line at 1.1569. The low today reached 1.1569. We currently trade at 1.1581 off that low and support area.

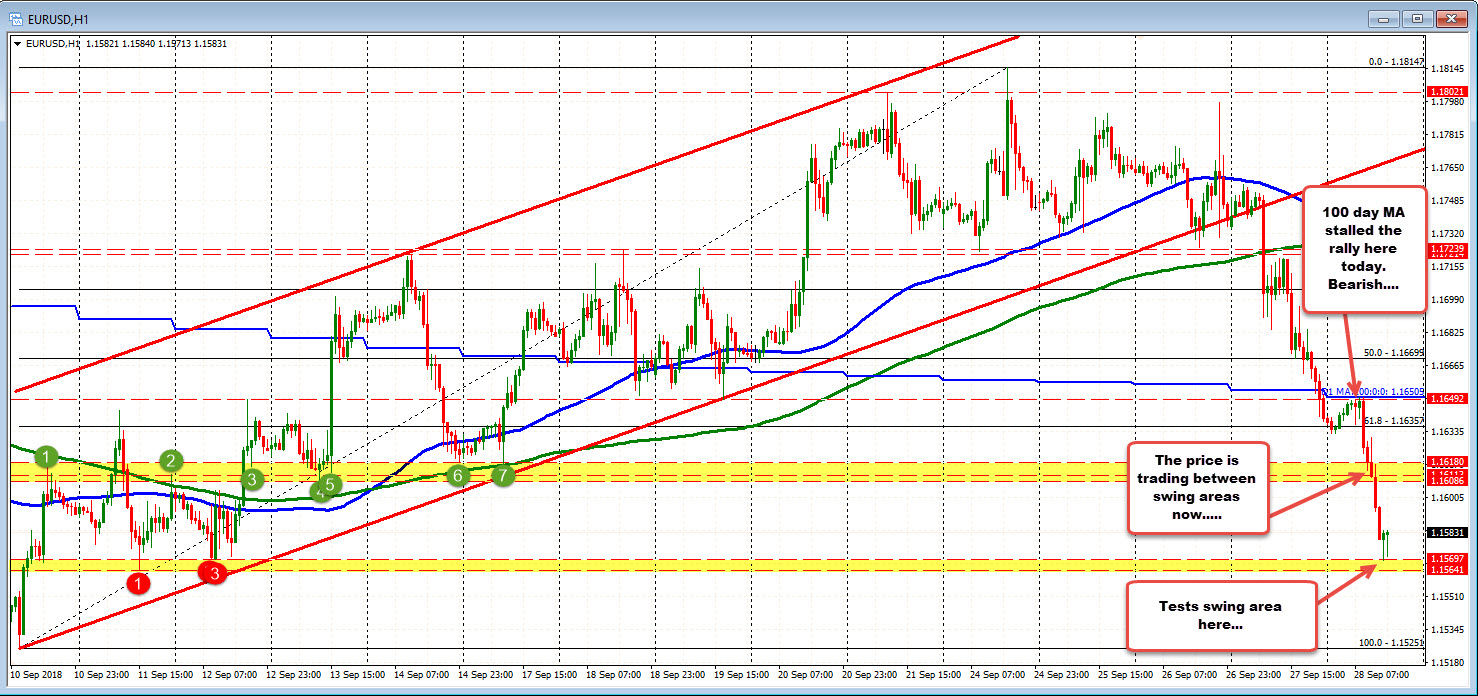

Drilling to the hourly chart below, as per above, the price stalled at the 100 day MA and fell off. The fall took out a swing area at 1.1608-18. The bottom reached a lower swing area at 1.1564-697. A break below that level will look toward the September low at 1.1525.

Taking another step to the 5-minute chart, the price decline has been steady with little corrections. The 38.2-50% of the day's range will be eyed at 1.1600-099. The 100 bar MA is also in that area at 1.1608. A move above that area would muddy the waters for the sellers.

There is reason to buy at the lows today from the daily and the hourly. What the market traders will be eyeing now is "Is the low, the low for the bigger move down, or just a corrective bounce area?". We do not know right now. A move above the 38.2%-50% of the days range (and 100 bar MA on the 5 minute) would add to a more bullish bias. Stay below is just a normal corrective move.