A little more bearish but more consolidation battle going on....

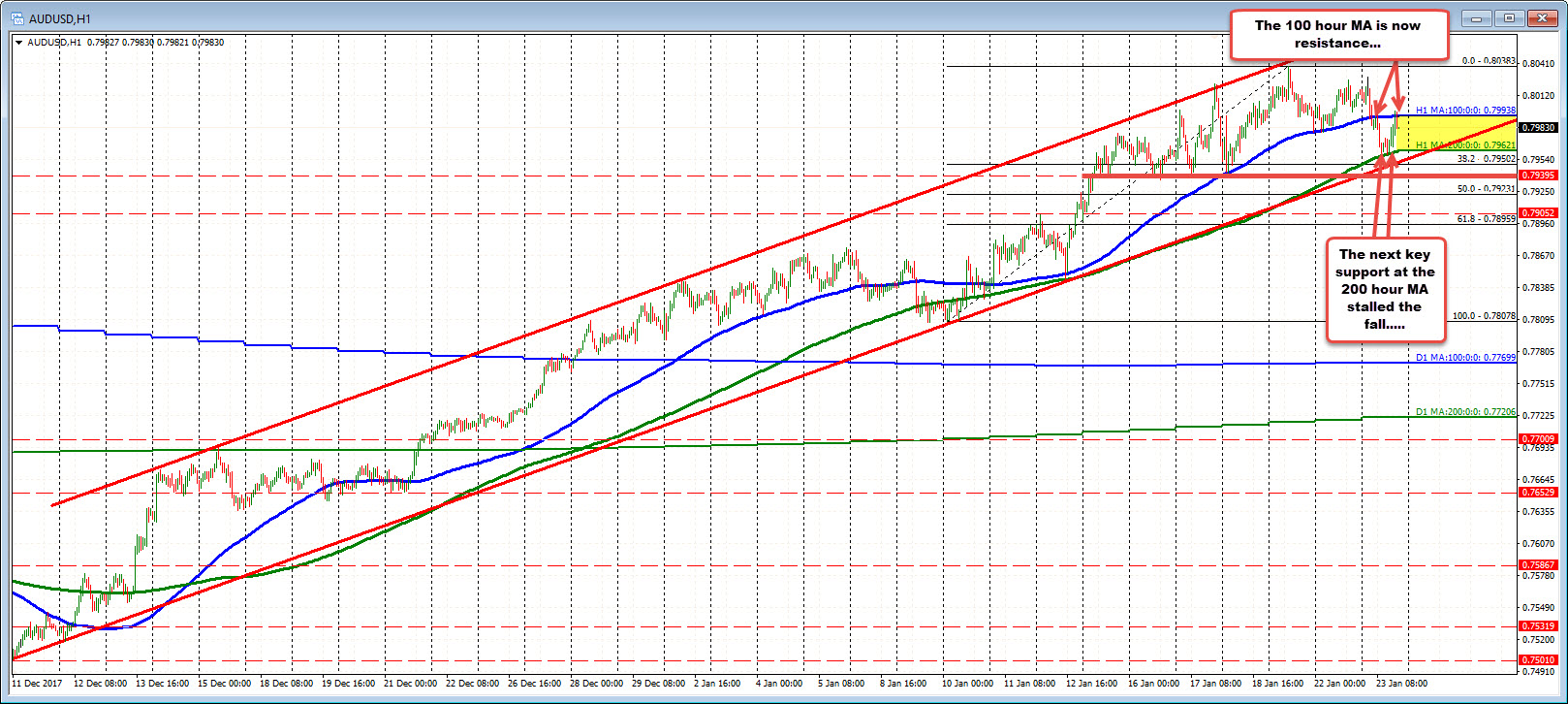

The AUDUSD has been in a long channel and remains in that channel. However, it has tilted a little to the downside today on the break of the 100 hour MA (blue line). That MA comes in at 0.79938 currently.

The fall took the price down to the next target at the 200 hour MA at 0.7962 where there were two separate tests.

The rally off that MA line retested the 100 hour MA and now we sit between resistance at the 100 hour MA above and support at the 200 hour MA below.

Looking at the last 7 days, and other technical levels, the pair may have peaked.

- The topside trend line stalled the last rises.

- The recent highs could not approach the highest high.

- The price fell below the 100 hour MA

However,

- The 200 hour MA stalled the fall twice

- The lower channel trend line has not been tested/broken

- The price is above the 38.2% of the last leg higher at 0.79502

- The 0.7939 area is another floor to get below

I call it a tilt to downside (sellers can lean against the 100 hour MA) but really just consolidating until the aforementioned levels below are taken out. Even so, there are more downside levels to get to and through.

It is what it is....A tilt to the downside.