100 hour MA halts the rally

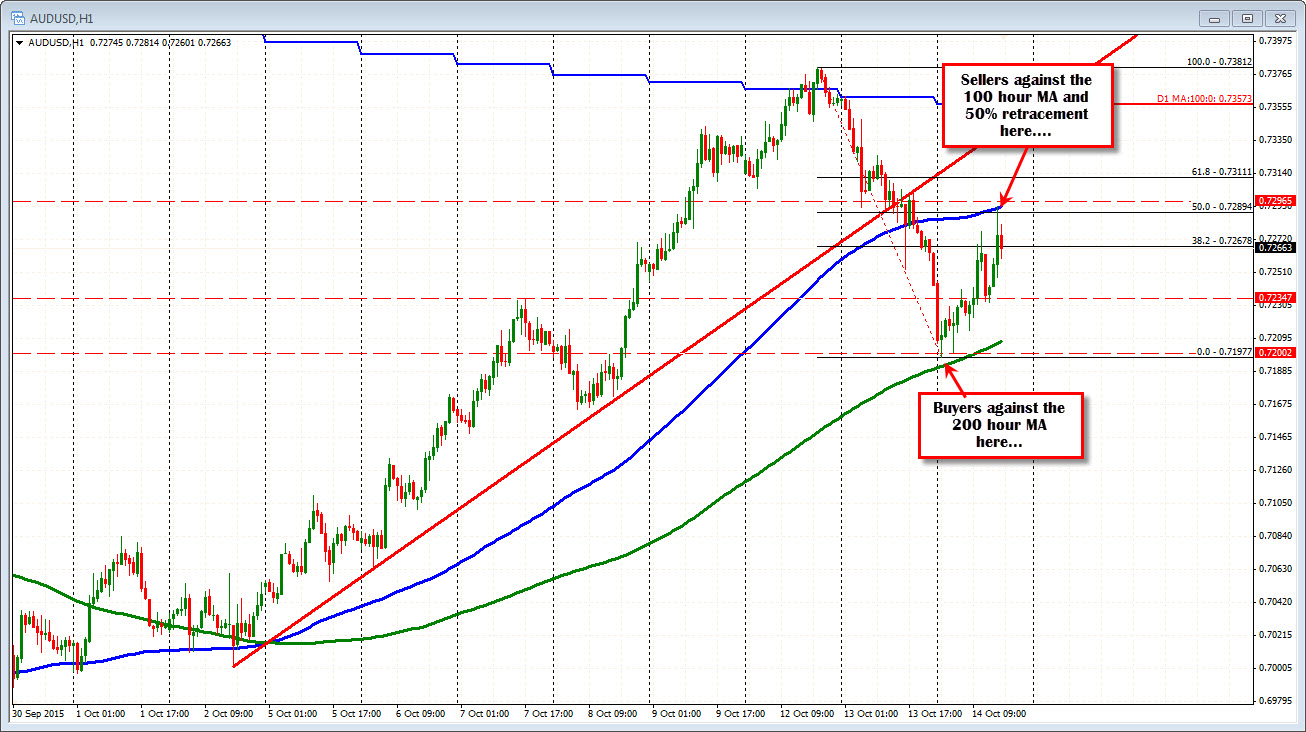

The AUDUSD is a bit confused. The reaction off the weaker US data was for a rise higher but it cautiously started to see sellers on fear that perhaps what is weakish news is not good for stocks and risk. Technically, the pair also found some sellers against the 100 hour MA and the 50% of the move down. Today's rally occurred despite weaker inflation data out of China today. Yesterday trade data in China was not that great.

Techincally, looking at the lows reached in the first few hours of Asia-Pacific trading, the pair found buyers against the 200 hour moving average (green line in the chart above). When the price trades between the 100 and 200 hour moving average (and those moving averages are spread apart) I call it trading between the goal posts. When the price trades between the goal posts, the market is saying it is unsure of the directional bias.

Looking at the chart, the pair just came off a rally from the October lows. That rally had 9 straight up days (i.e higher closes). Yesterday was a different story as the pair fell below the 100 day moving average, trend line support, and 100 hour moving average before stalling at the 200 hour moving average (green line in the chart above). Below the 100 hour MA is bearish. Staying above the 200 hour MA is bullish. Hence the dilemma.

US stocks are opening with the S&P down 1.95 and the Nasdaq up 4.9 in early trade. Will the pair keep an eye on the equities for risk on/risk off clues? Could be, but look for traders to continue to lean against the topside resistance from the 100 hour and 50% retracement. Risk can be defined and limited and traders like that dynamic when there is uncertainty.