Pair has been consolidating at 2017 highs over the last few months

The EURJPY has moved below the 100 bar MA and 200 bar MA on the 4-hour chart at the 132.908 and the 132.66 levels respectively. It also cracked below an upward sloping trend line at the 132.91 area. The combination has sent the pair lower. Risk is now at those level with the 132.66 the best case for the sellers/bears.

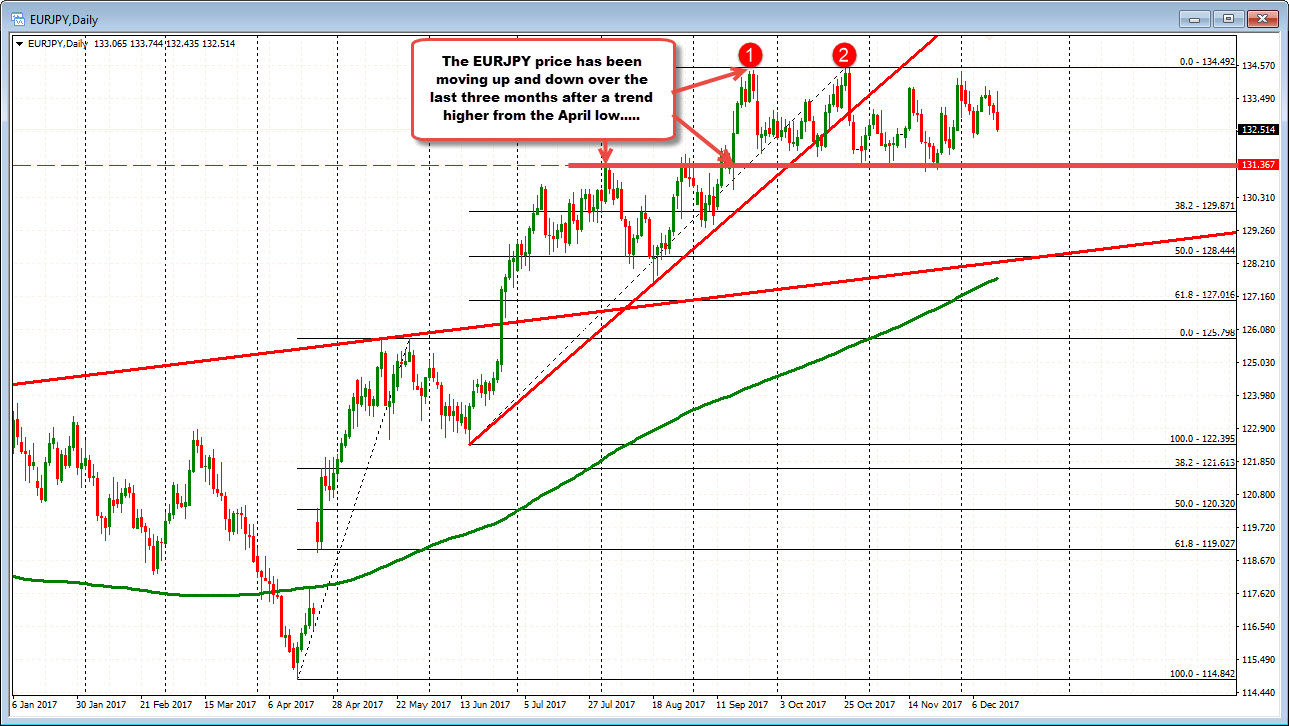

Looking at the daily chart for the pair, the price moved above the August swing high at the 131.37 area in mid September, and has spent the last 3 months trading above that level. The middle of that range is at 132.82. On the move lower today, the price fell below that midpoint.

So the technical picture from a intermediate term perspective is more bearish. The daily picture is leaning that way too below the 50% midpoint. There is some work to do, however, at the range lows.