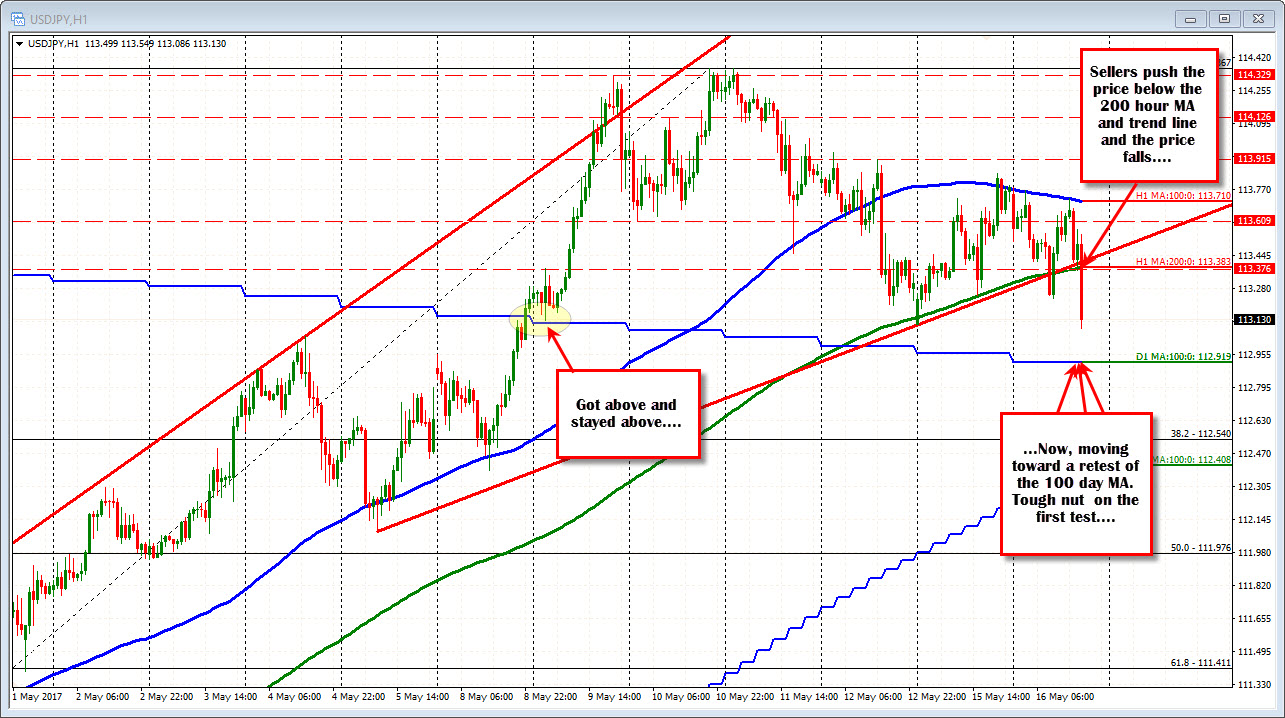

100 day MA being approached.

The USDJPY has cracked below the support line defined by the 200 hour MA and trend line (see prior post). The fall has the pair moving toward the 100 day MA at the 112.918. Back on May 8th/9th that MA line was broken and tested before moving higher. I would expect that buyers will lean against the level on the first test, with stops on a break.

Stocks have reversed lower and are now in the red (S&P is down -0.19% and the Nasdaq is down -0.10%). The US bond yields are also in the red now with the 10 year down 3.3 bp to 2.3099%. At the start of the day, the yield was higher by 1.0 bp at 2.3591%