2.4B expires at 112.30

Mike tells me, the 112.30 level has 2.4 bln expiring at 112.30 and we currently trade at 112.30. Options expire worthless at the strike price. That benefits sellers of option who want to see the decay go right to 0. That his the best case scenario. That may be what the greedy sellers are hoping for as the clock ticks to the 10 AM ET/1600 GMT option expire time.

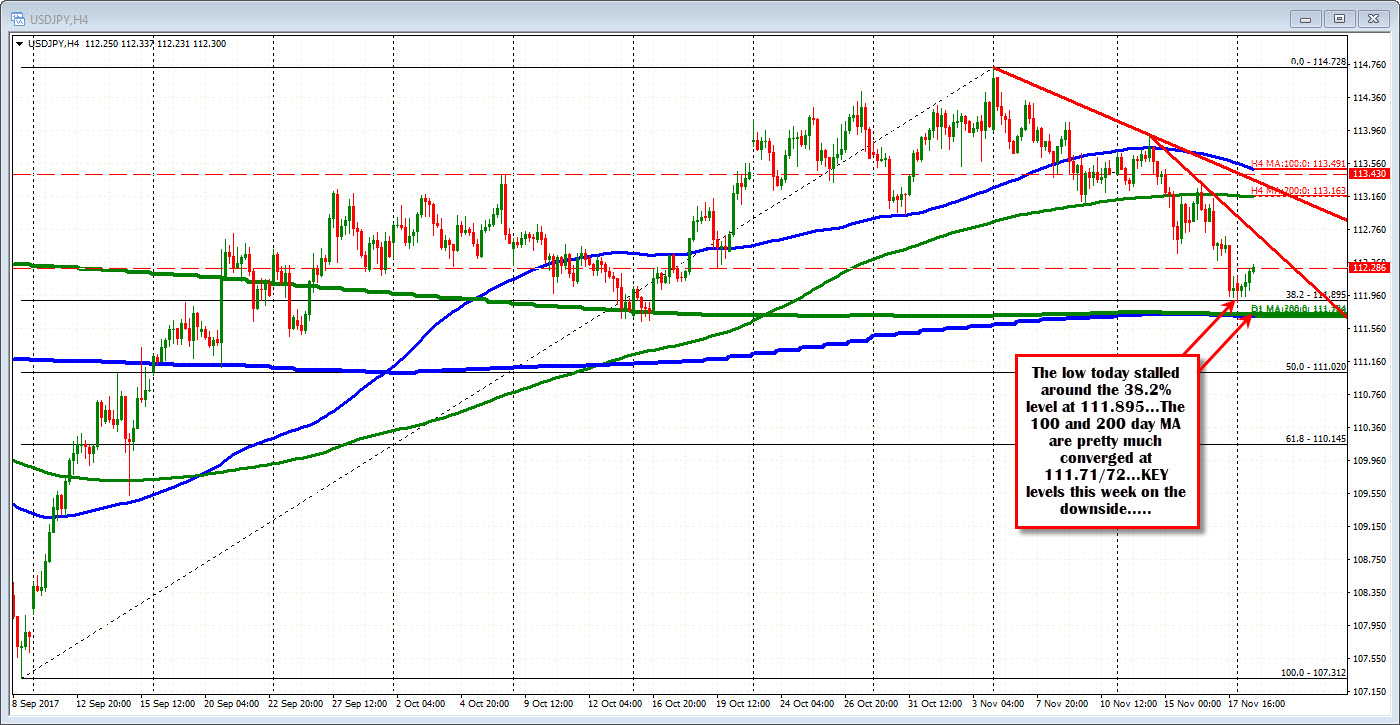

Technically the pair moved lower earlier (the low was in the early Asian trading) and bottomed at 111.88 (see chart above).. The 38.2% of the move up from the September 8th comes in at 111.895. Buyers leaned against retracement support.

They likely ALSO leaned early against the 100 and 200 day MAs. The 100 day MA comes in at 111.71. The 200 day MA comes in at 111.72. That level will be key this week too. Move below is more bearish. Stay above is more bullish. Keep the level in mind on more weakness for the pair..

So do we go higher after the cut off?

Drilling to the 5-minute chart, the most recent swing low stalled at a trend line (more bullish) and just above the 100 bar MA (blue line). So the buyers are trying to keep a floor and push the price higher. Stay above those level will be more bullish - - at least intraday. A move below and the buyer may give up (look for a bigger rotation lower).

Helping the pair recover today, is a move higher in yields. They are not running but after being down about 1 bp earlier in the session, rates are higher now. Stocks are also higher - modestly.