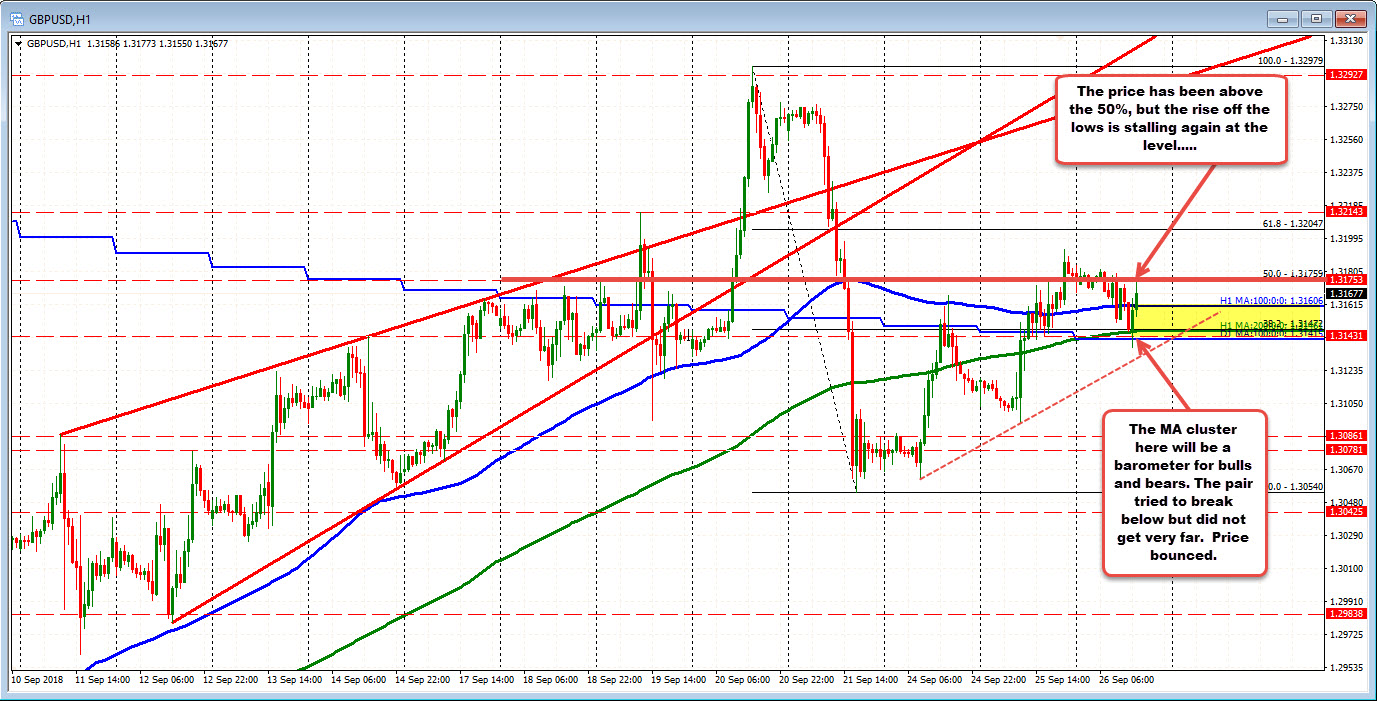

The MAs will be a barometer for traders in the near term (and through the Fed decision/Brexit news). Also eye the 50% of last week's move.

Yesterday, the GBPUSD moved up and through a cluster of MAs including the 100 and 200 hour MAs and the 100 day MA (blue and green lines in the chart below and yellow area).

The cluster of MAs today come in between 1.31415 and 1.31606. The price of the GBPUSD -since breaking above yesterday - has been more or less tethered to the cluster. Yes, there was a move higher (and also above the 50% of the range from last week at 1.31759), but momentum to the upside faded and the price was pulled back toward the MA area this morning.

Right now, the 50% at 1.31759 is stalling the rebound off the MA cluster support. Battle lines have been drawn.

With the dollar influence from the Fed and presser this afternoon, and the persistent Brexit comments and negotiations, it is not too surprising that the price has anchored to the MAs for now and is bobbing up and down.

However, at some point, the tethered line will break and there will be a run away (either higher or lower).

The 50% looks like a level to get and stay above if the price is going higher.

On the downside, getting below the cluster of MAs (with the 100 day MA at 1.31415 the lowest), will be eyed for a more bearish bias.