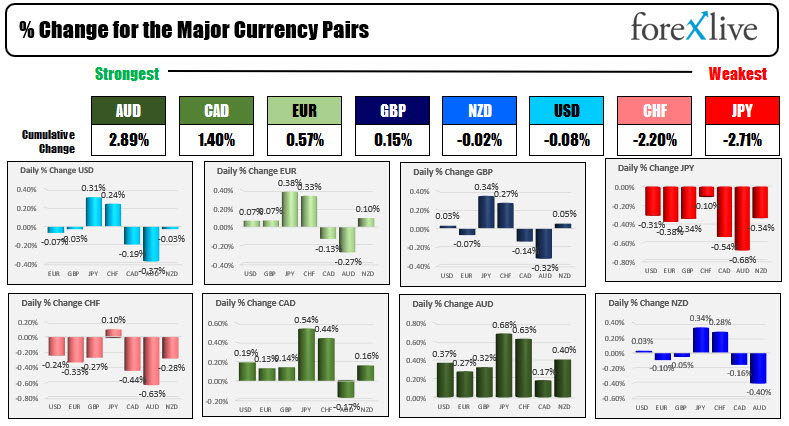

The USD is mixed to start the North American session

As the North American session begins, the AUD is the strongest and the JPY is the weakest. The USD is mixed with gains vs the JPY, CHF and NZD and declines vs the AUD, CAD, EUR and GBP. The ADP report will be released at 8:15 AM ET with the expectation for 640K vs 330 last month. Recall that last months number was way off the NFP report of 943K. Nevertheless, it still is a release and markets tend to react as they gear up for the more important jobs report on Friday. Also today will see the release of the PMI manufacturing index (Markit and ISM versions). The Markit is expected at 61.2. The ISM is expected at 58.5. OPEC meets (expectations they they will continue to add at a rate of 400K barrels a day each month). The demand side is being influenced by the ups and downs in the global Covid picture with China a focus. That seems to be stabilizing. Canada Manufacturing PMI will also be released.

In other markets:

- Spot gold is near unchanged at $1813.44

- Spot silver is up $0.10 or 0.43% at $23.97.

- WTI crude oil futures are up $0.13 or 0.19% at $68.63

- Bitcoin is trading up about $500 and $47,712

In the premarket for US stocks. The major indices are trading higher after yesterday's modest declines. Both the S&P and NASDAQ aim for new records today. The S&P completed the seventh consecutive monthly gain yesterday. Today is the start to the new month.

- S&P index is up 17.07 points after yesterday's -6.11 point decline

- Dow is up 131 points after yesterday's -39.11 point decline

- NASDAQ index is up 50 points after yesterday's -6.65 point decline

In the European equity markets, the major indices are sharply higher in trading today

- German DAX, +0.3%

- France's CAC, +1.4%

- UK's FTSE 100, +0.9%

- Spain's Ibex, +1.9%

- Italy's FTSE MIB, +0.9%

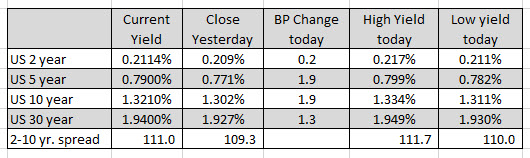

In the US debt market, yields are higher with the tenure leading the way with a 1.9 basis point gain to 1.3210%

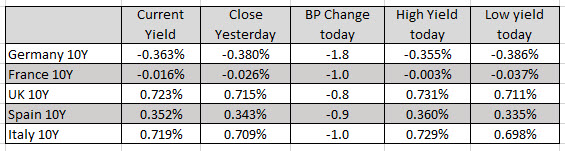

Looking at the European debt market the benchmark 10 year yields are trading lower. Francis 10 year got closer to unchanged on the day with a high yield of -0.003%. It currently is trading at -0.016%.