The USD is weaker the "day after"

The FOMC layed the road for taper to begin in 2021 and end by the midyear of 2022 at their meeting this week. Despite that the USD is weaker today. The BOE had some hawkish undertones in their decision today that is sending the GBP higher. Norway raised rates becoming the first among the more "advanced economies", to increase rates. China continued to inject liquidity into the system to keep markets steady as Evergrande situation plays out (see here and here).

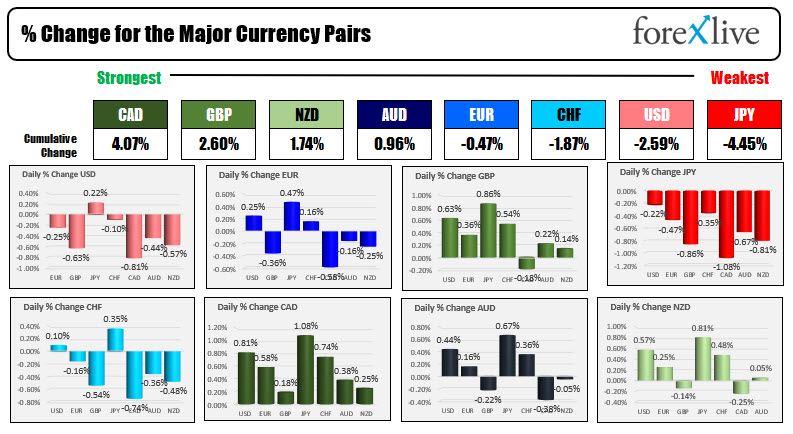

Overall the CAD is the strongest of the majors followed by the GBP. The JPY and the USD are weakest.

The weekly initial US jobless claims data will be released at the bottom of the hour along with Canada retail sales. The Markit preliminary flash PMI data will be released at 9:45 AM ET. The conference Board leading indicators will be released at 10 AM ET.

In other markets as the US trading day gets underway:

- Spot gold is up $4.75 or 0.27% at $1773

- Spot silver is up five cents or 0.23% at $22.71

- WTI crude oil futures are down $0.36 or -0.5% $71.87

- bitcoin is trading near unchanged at $43,524

in the premarket for US stocks, the major indices are higher after gains yesterday. The S&P and Dow snapped a four day decline. The NASDAQ was higher for the second consecutive day. The futures are implying:

- Dow Jones up 197 points

- S&P index up 21.41 points

- NASDAQ index up 69.34 points

In the European equity markets,

- German Dax +0.7%

- France's CAC +0.7%

- UK's FTSE 100, unchanged

- Spain's Ibex +0.65%

- Italy's FTSE MIB +0.9%

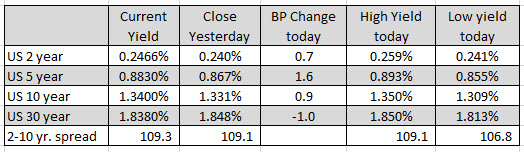

A snapshot of the US debt market is showing yields are mixed:

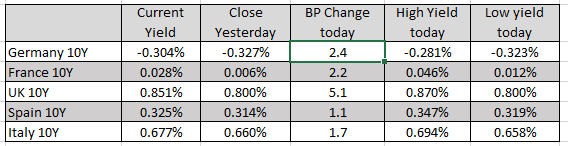

In the European debt market, the benchmark 10 year yields yields are higher. UK 10 year yields are up the most that +5.1 basis point after the Bank of England decision: