AUD/USD takes a peek above the 100-day moving average

As buyers look to break the bearish bias/momentum in the pair, there are a number of factors to start considering about further upside in the aussie to start the year. For one, all the reasons to be bearish on the currency are very much known and factored in at this point:

- RBA not going to hike rates again this year

- Economy under threat from China slowdown and high household debt domestically

- Housing market continues to soften

- Inflation still nowhere near comfortable levels for the RBA

- Wage growth still not convincing enough to see sustained inflationary pressures

So now, let's start to see what is going in the favour of AUD/USD instead. Firstly, the Fed is turning more dovish now and markets aren't going to factor in rate hikes just yet unless economic data tells the Fed that they can't ignore the signs and must hike once again. I don't believe that US economic data recently is running that hot so that presents an opportunity for AUD/USD to capitalise on the Fed's pause.

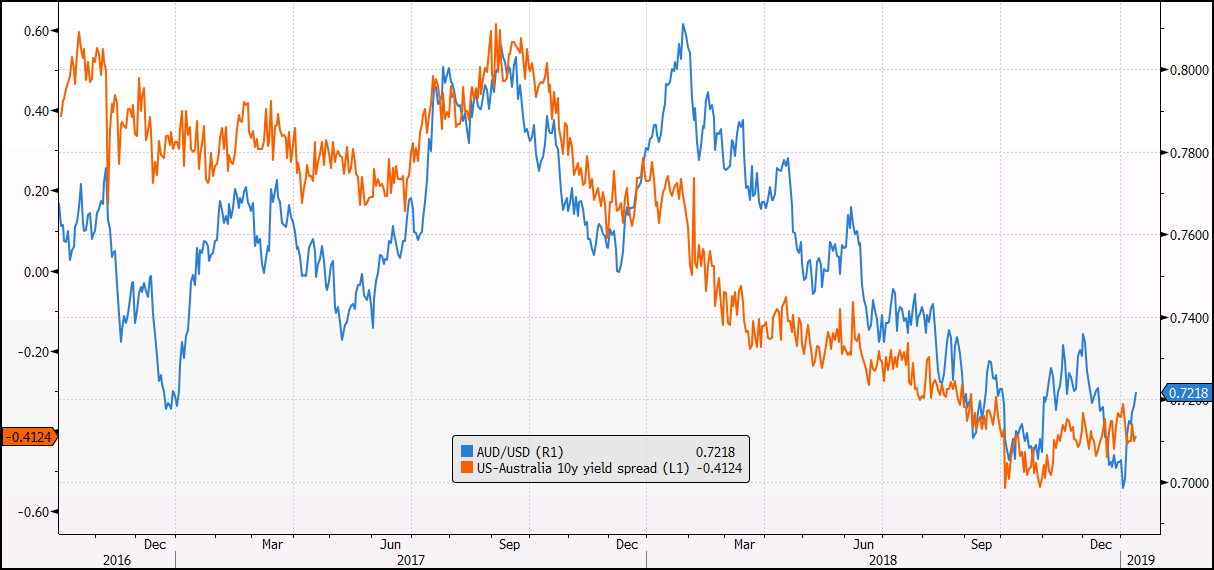

The fact that yield differentials have also narrowed recently makes for a compelling case that monetary policy divergence will be less of a factor in AUD/USD for now. The 10-year bond yields spread between the two now sits at 41 bps in favour of Treasuries, down from 54 bps seen in October last year.

Aside from that, the technical breach of the 100-day MA (red line) is significant and will at least help buyers build further conviction to the upside with resistance levels next seen around 0.7239 and then near 0.7315-30. If buyers manage a break of the 200-day MA (blue line), it will be a major boost and I reckon that will fuel a move back above 0.7400 at the very least.

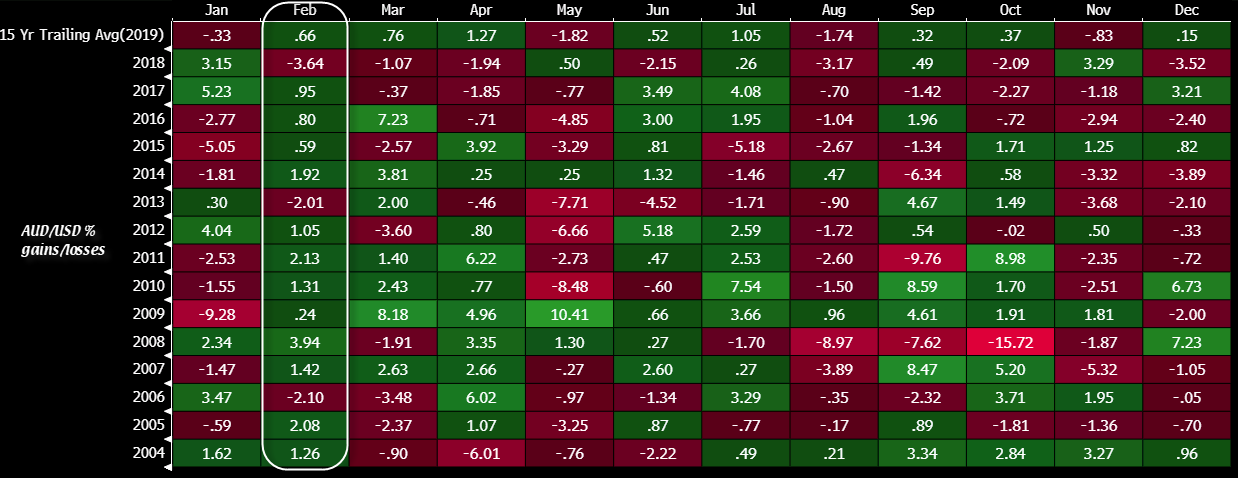

The other outside factor to consider as we start the year is that seasonal patterns also suggest that AUD/USD has room to maneuvre in an upside move:

Although we're only in January, buyers can look forward to the month of February where price has gone up in 12 out of the last 15 years (the setback here is that price fell last year in February).

But in any case, I'd be watching the two main factors of the Fed and risk sentiment when trading the pair. With US-China trade talks still showing some optimism for now and the Fed opting to angle more towards a dovish stance to start the year, it makes a compelling case for a higher AUD/USD in the near-term outlook.