The USD is mostly lower to start the day. Month end. Stocks lower. Yields down.

The Omicron ghost has spooked the market again today after a reprieve yesterday.

Moderna CEO warned that the current vaccines might not be effective with the variant. Regeneron said that the antibiotic cocktail is less effective against Omicron virus (results from early tests).

That news helped to send stocks lower, yields lower, and oil lower.

Fed chair Powell will testify on Capitol Hill. His pre-released remarks were more hawkish saying that inflation is likely to linger well into next year and that the concerns with the virus could reduce people's willingness to work in person, increasing supply constraints. Feds Williams and Clarida are also scheduled to speak today. Treasury Secretary Yellen is also testifying.

European inflation rates were higher than expectations with the flash CPI estimate for November rising to 4.9% versus 4.5% expected. On the other end of the spectrum, German unemployment change came in better than expected at -34K versus -25K estimate.

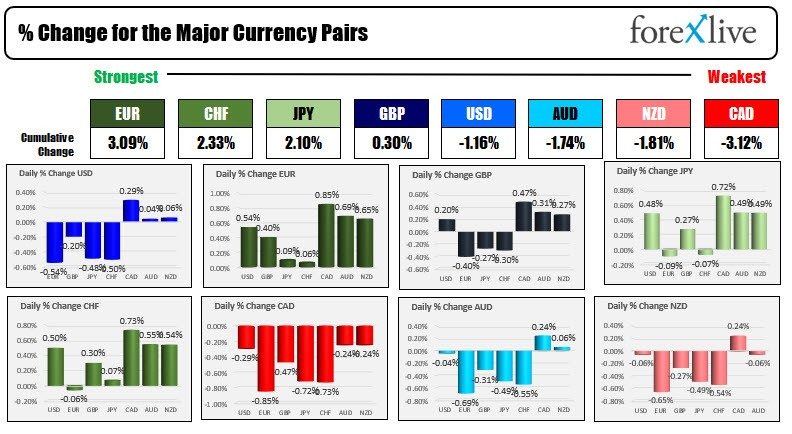

In the forex, the snapshot of the market currently shows the EUR is the strongest of the major currencies while the CAD is the weakest. Lower oil prices are helping to push the CAD to the downside with the CAD the weakest vs the USD since September 22.

It is month end which can influence trading flows. The Dow is down this month while the Nasdaq is higher. The S&P is near unchanged levels.

In other markets, the US opening snapshot shows:

- Spot gold is up $8.65 or 0.48% at $1792.50

- Spot silver is down and two cents or -0.08% at $22.87

- WTI crude oil futures are trading down nearly 2 dollars at $68.04. The premarket low reached $67.08

- Bitcoin is trading marginally higher $58,209

In the premarket for US stocks, the major indices are lower after yesterday's rebound:

- Dow industrial average -379 points after yesterday's 236.6 point rise

- S&P index -44 points after yesterday's 60.65 point rise

- NASDAQ index -85 points after yesterday's 291.18 point surge

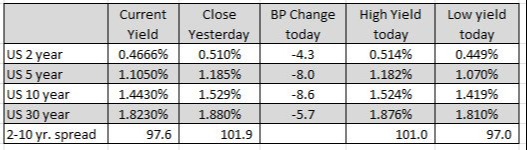

In the US debt market, yields are sharply lower with the 10 year trading back below 1.5% at 1.443% (down -8.6 basis points). The 2-10 year spread is back below the 100 level at 97.6 basis points. Last week the 10 yield was as high as 1.691% (down 25 basis points). The two year was as high as 0.658% (down nearly 20 basis points). Markets are implying a September 2022 rate hike versus June before the Omicron news

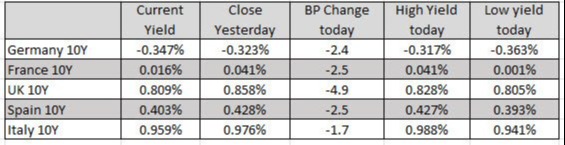

In the European debt market, benchmark 10 year yields are also lower, reacting to the slower growth prospects and despite the higher inflation data (but less reactive vs the US equivalent). UK 10 year yields are down -4.9 basis points. France's 10 year is back toward parity at 0.016% after trading as low as 0.001%.