Major indices are a little higher at the opening

The opening bell has sounded and the US stocks are modestly higher. Today is quadruple witching day in stocks which tends to inflate volatility. Quadruple witching day is when stock index futures, stock index options, stock options, and single stock futures expire at the close. As Adam pointed out earlier, there are 8.292B in S&P 500 options expiring at 3000. S&P futures are currently trading up seven points at 3015.

A snapshot of the major indices is showing:

- S&P index up 6.35 points or 0.21% at 3013.20

- NASDAQ index is up 7.8 points or 0.10% at 8190.62

- Dow industrial average is up 52 points or 0.20% at 27145

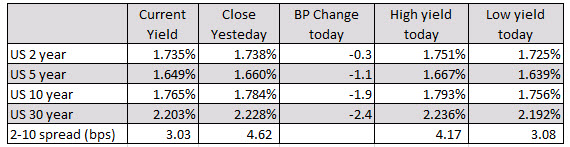

in the US debt market yields are extending more to the downside with the yield curve flattening (2-10 is at 3.03 basis points versus 4.62 basis points at the close yesterday).

A snapshot of other markets shows:

- Gold is remaining relatively steady trading above and below the $1500 level. It currently is up $4.20 or 0.28% at $1503.50

- WTI crude oil futures are up $0.55 or 0.95% at $58.68

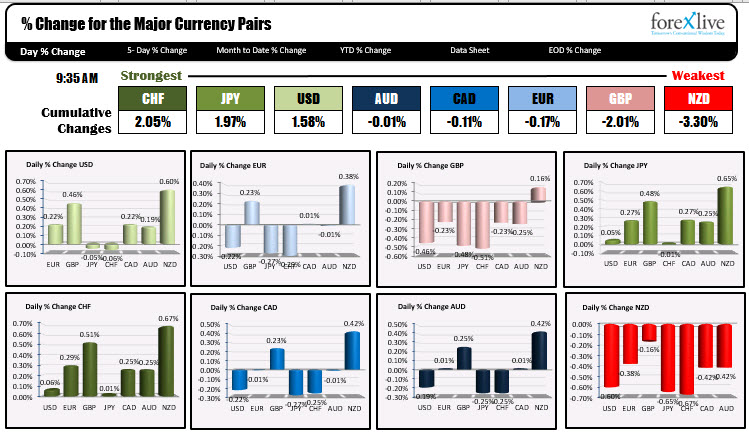

In the Forex market, the CHF remains the strongest and the NZD remains the weakest of the major currencies. The EUR and GBP has moved lower since the start of the New York session.