As the North American session begins, the CHF is the strongest and the NZD is the weakest. The USD is mixed with gains vs the CAD, AUD, NZD and GBP, and declines vs the EUR, JPY and CHF.

US stocks are trading lower after Netflix earnings plunged on slowing subscriber growth, and lower revenues/earnings going forward. The stock is down -19.5% in premarket trading. The Nasdaq index is down 5% this week and is set to add to those losses today. For the year the index is down -9.53% (at the close yesterday). Netflix is the first "big" name to report. More to come over the next few weeks.

The S&P moved away from its 100 day MA at 4576.31 this week. The 200 day MA is down at 4427.70. The price closed between at 4482.74. The S&P is down -6.64% from its all-time high reached on January 4.

The Nasdaq moved below and away from its 200 day MA this week. The key moving averages is now at 14736 (price closed at 14154.02 yesterday). The NASDAQ index is down -12.7% from its all-time high back in November.

The Dow fell below its 200 day MA yesterday at 34945 (closed at 34715 yesterday). The Dow industrial average is down -6.18% from its all-time high reached at the start of January.

Major indices are on pace for their worst week in a year.

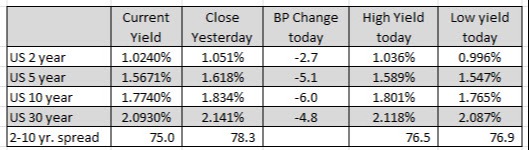

US yields have slowed their rise at least in the longer end as the debt market adjust from inflation to slower growth with inflation thanks to lower stocks. The 10 year yield is down around -5 basis points to 1.78% after trading as high as 1.90% earlier this week.

Crude oil is coming off as well perhaps in reaction to slower growth/perhaps some profit taking. Yesterday, the weekly inventory data showed an unexpected build in oil inventories, and another large increase in gasoline inventories. The price of oil reached a 7-year high this week.

In the US, leading indicators will be released at 10 AM. Canada releases its retail sales at 8:30 AM.

The Fed remains in its quiet period. Their interest rate decision will be announced on Wednesday next week. Will they announce the completion of the taper early, paving the way for an earlier tightening? Will they speak more to reducing the balance sheet? Those questions seem to be the surprise potential this month.

In other markets, the morning snapshot shows:

- Spot gold is trading down $-4.21 or -0.23% at $1834.40

- Spot silver is down nine cents or -0.37% at $24.38

- WTI crude oil is trading down $1.27 at $84.28

- Bitcoin toyed with the idea of breaking higher yesterday, but has reversed quickly to the downside and trades at $38,283

In the premarket for US stocks, the major indices are trading lower. All three major indices are trading down

- Dow industrial average is trading down -101 points after yesterday's -313.26 point decline

- S&P index down -26.5 points after yesterday's -50.03 point decline

- NASDAQ index down 137 points after yesterday's -186.23 point decline

In the European equity markets, major indices are trading lower across the board as a place catch up to the sharp decline in the US stock market afternoon session yesterday

- German DAX, -2%

- France's CAC -1.78%

- UK's FTSE 100 -1.1%

- Spain's Ibex -1%

- Italy's FTSE MIB -1.8%

US yields are lower with the longer end down the most as the yield curve flattens.

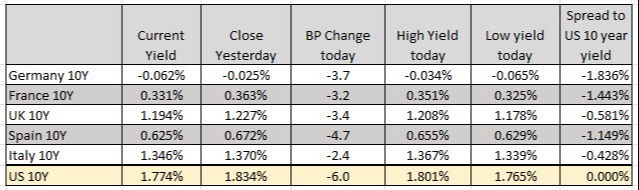

European shares are lower as well with the benchmark 10 year yields down across the board