The forex market is a bit of a jumble to start the day with the USD and CAD as the strongest and the CHF and NZD as the weakest.

US stocks are lower again in pre-market trading after the incredible comeback yesterday (Nasdaq down around 300 points or -2.11%),. Such price action often leads to risk off flows. That typically helps to give the USD, CHF and JPY support and hurts the CAD, NZD and AUD. The rankings of the strongest to weakest has instead pushed the CHF lower and the CAD higher today and scramble up the other currencies.

The USDCHF has been trending steadily to the upside (lower CHF) from near the start of the day and did move back above its 200 day MA which helped the technical view for that pair (at 0.9162 area). Meanwhile, the USDCAD rotated lower in the North American afternoon yesterday, and found support buyers near the 100 day MA. The loonie is mostly higher vs the other currencies especially the CHF and NZD today. It also has the advantage of oil which is near unchanged in early trading (currently at $83.30) but was as high as $84.50 today. That can also be a support for CAD.

The US consumer confidence and Richmond Fed manufacturing index released at 10 AM ET. Prior to that the S&P Case Shiller home price index released at 9 AM ET.

The FOMC will start their two day meeting today with taper, rate changes, balance sheet and timing of all making the decision one of the more complex in recent memory. That decision will be made at 2 PM ET tomorrow.

In other markets, the morning snapshot shows:

- Spot gold is trading down -$2.50 or -0.14% at $1840

- Spot silver is down $0.27 or -1.12% at $23.69

- WTI crude oil is trading near unchanged at $83.30

- Bitcoin is trading at $36555 after trading as low $32950 yesterday

In the premarket for US stocks, the major indices are trading lower. Microsoft reports after the close. American Express did beat expectations on top and bottom lines in pre-market release. The stock is trading near unchanged indicative of the negative bias in the markets (or so it seems).

- Dow industrial average -280 points after yesterday's 99.13 point rise yesterday

- S&P index down 62 points after yesterday's 12.19 point rise

- NASDAQ index -290 points after yesterday's 86.21 point rise yesterday

In the European equity markets, major indices are trading mostly higher as they play some catch up from the sharp falls yesterday

- German DAX, +0.7%

- France's CAC +1.0%

- UK's FTSE 100 +1.0%

- Spain's Ibex +1.0%

- Italy's FTSE MIB +0.5%

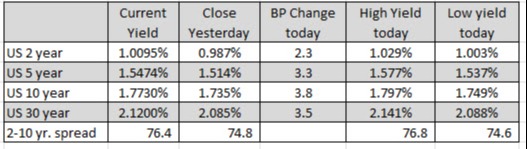

The US 10 year yield is trading around 1.77%. It traded up to 1.902% last week. The 2 year is near 1.0% after a stellar auction yesterday in that issue.

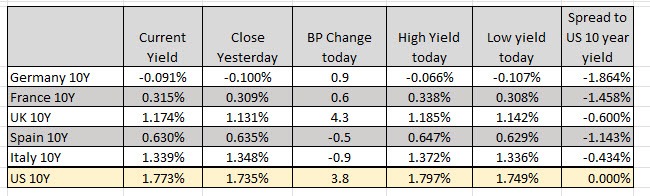

In the European debt market, the benchmark 10 year yields are mixed: