Forex news for US trading on Feb 2, 2016:

- S&P unleashes a new list of downgrades to oil companies

- Spanish socialists given mandate to form government

- US Jan light vehicle sales 17.58m vs 17.2m est

- Japan to call off March sale of 10-year bonds because of negative yields

- Fed's George: US needs investment pickup to sustain long-term growth

- Fed's George: Timing of each hike is subject to economic outlook

- ECB's Mersch: Do not assume we will increase stimulus in March

- IBD/TIPP US economic optimism 47.8 vs 47.6 prior

- January 2016 US ISM New York business index 54.6 vs 62.0 prior

- Another oil deal bites the dust as China's Fortune Group backs out of Rosneft deal

- Soft NZ dairy auction

- Gold up $1 to $1129

- WTI crude down $1.17 to $29.91

- US 10-year yields down 9 bps to 1.86%

- S&P 500 down 36 points to 1903

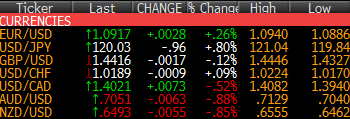

- JPY leads, AUD and NZD lag

It was Groundhog Day and stop me if you've heard this one before: Worries about emerging markets and growth along with oversupply weighed on oil prices and that spilled over into selling the stock market and USD/JPY.

USD/JPY was down nearly a full cent on the day and almost all of it came in US trading as sentiment deteriorated. S&P 500 futures were down about 14 points before the open but things deteriorated as oil began to slide.

Crude came under steady selling pressure and finished just below $30 from $30.55 at the start of US trading. USD/CAD rose up to 1.4080 in an early 100-pip jump but retraced back to 1.4035 even as oil remained at the lows.

Cable was less of a focus today. It tried to break Monday's high of 1.4444 and managed to get to 1.4446 in early US trading but it was almost immediately beaten back and then slipped down to 1.4365 before finishing above 1.4400. The top end of that range is key going forward.

NZD/USD wobbled lower on the soft Fonterra auction but it was a 20 pip blip to a session low that quickly recovered. Despite the poor environment, it finished slightly higher in US trading. The kiwi jobs report is up next.

EUR/USD tried the upside and hit 1.0940 but gains to those levels have been sold hard and repeatedly and that was the case again. Heavy sales into the London fix knocked it down to 1.0891 and then it was a slow recovery late to 1.0917.