The major US stock indices are opening higher. The Dow and S&P are working on their 2nd day in a row to the upside. The NASDAQ index is looking to snapped a 5 day losing streak. A snapshot of the market currently shows:

- Dow industrial average +125 points or 0.4% 31782.50

- S&P index up 22.69 points or 0.57% at 3990.10

- NASDAQ index up 57.47 points or 0.50% at 11843.20

- Russell 2000 up 10.3 points or 0.57% at 1833.12

Taking a look at other markets:

- spot gold is up $13 or 0.77% at $1709.06

- spot silver is up $0.19 or 1.1% at $17.95

- WTI crude oil is moving higher and up about $2 at $88.84

- bitcoin is marginally higher $20,359

In the US debt market, yields are mostly lower

- 2 year yield 3.426%, -8.2 basis points

- 5 year 3.324%, -7.7 basis points

- 10 year 3.223%, -3.4 basis points

- 30 year 3.377%, +1.3 basis points

In the forex,

- EURUSD: The EURUSD continues to trade around their 100 hour moving average at 1.0003. The 200 hour moving average below is at 0.99834. Stay above the moving averages keeps the buyers in play. Move below and there further should be further rotation back to the downside is the bias tilts intraday in the downward direction again.

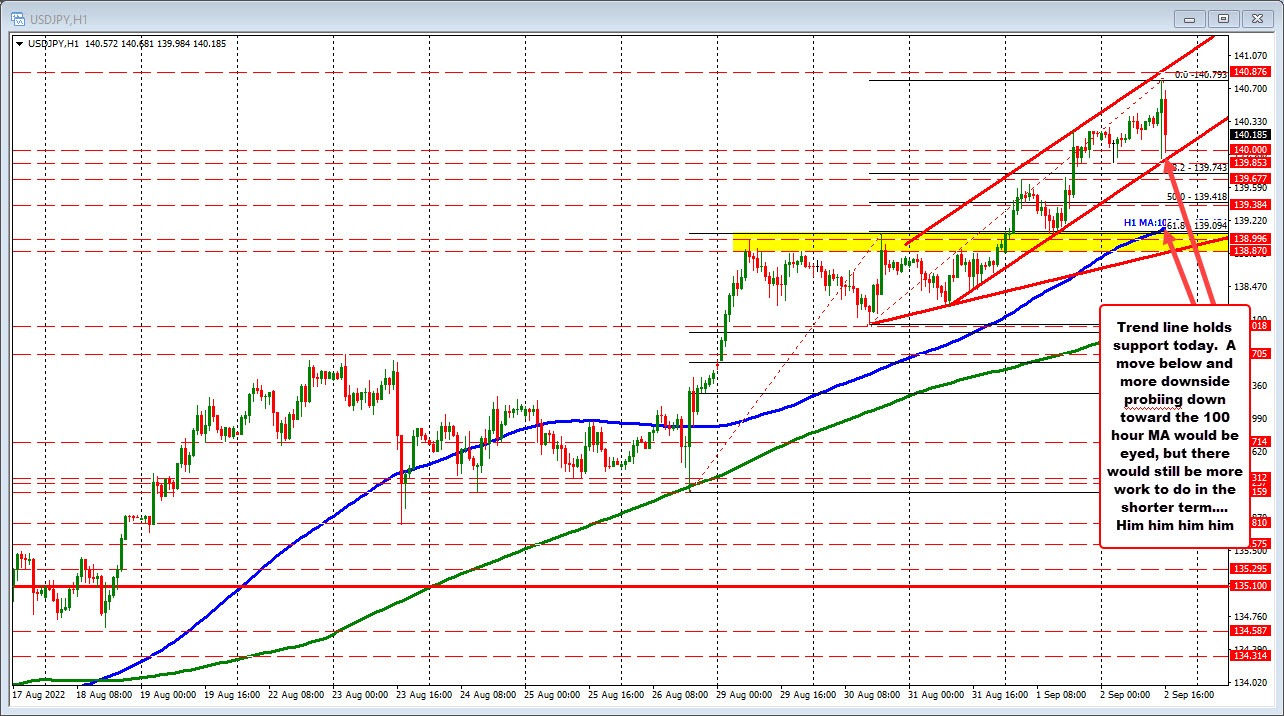

- USDJPY: The USDJPY is still higher on the day but coming off the higher levels (and highest level going back to 1998 at 140.793. The current price trades at 140.20. On the downside, a trendline on the hourly chart cuts across near 139.90 currently. Move below that level and the 38.2% retracement of the move up from the low on Tuesday cuts across at 139.743. The 100 hour moving average is down below at 139.12

USDJPY holds lower trendline support

GBPUSD: The GBPUSD trades to a new low in the currently hourly bar after ticking to a new high after the jobs report. The high reached 1.15875. The low price just reached 1.15254. The current price iss trading at 1.1548 in up and down trading.