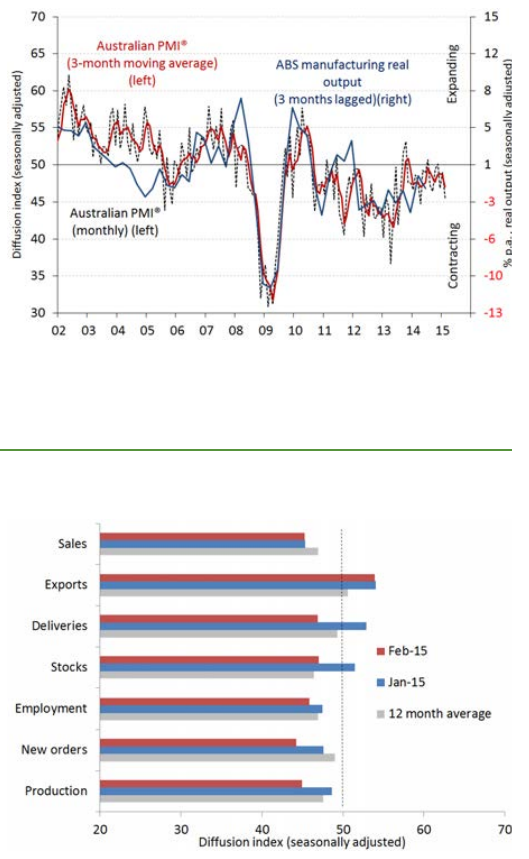

AIG Performance of Manufacturing index for February,

Fall of 3.6 points

3 consecutive months of contraction

Key points:

- 4 of the eight manufacturing sub-sectors expanded in February: food, beverages and tobacco; textiles, clothing & furniture; and the non-metallic mineral products (down 2.3 points to 66.2).

- Contractions - machinery and equipment; printing and recorded media; metal products; and wood and paper products

- Petroleum, coal, chemicals & rubber products sub-index to its lowest reading since June 2009 (decline in global oil prices, ongoing decline of local mining construction activity, the progressive closure of automotive assembly weighing on sales of Australian-made chemical inputs and components).

- Among the activity sub-indexes, only manufacturing exports expanded in February. Manufacturing production declined for a fourth month, new orders declined for a third month, and manufacturing sales recorded a ninth consecutive month in contraction.

- Manufacturing employment contracted for a second month in February

- Input costs remain elevated (up 5.1 points to 72.4), while selling prices continued to contract (down 1.4 points to 48.3). The wages sub-index increased slightly, rising 1.8 points to 55.3

Comments from Ai Group Chief Executive, Innes Willox:

"While there are bright patches, most notably for food & beverages and producers of building materials, weak domestic demand from businesses and households is offsetting the boost that many domestic manufacturers might have expected to flow from the weaker Australian dollar. Particular drivers of flat domestic demand include the sharp drop in mining construction; the progressive closure of automotive assembly; and weak local business investment. The lower dollar has also lifted the prices paid for imported inputs, putting additional pressure on manufacturers' margins. On the positive side, the lower dollar and its further depreciation since September 2014 have boosted manufacturing export volumes over recent months.

"The weakness of domestic demand certainly provides further backing for the Reserve Bank's decision in February to reduce interest rates and it underlines the importance of using the May Budget to provide a boost to domestic activity - including by delivering on the commitment to cut the company tax rate to 28.5 per cent for all companies"

Here's a sad picture ...