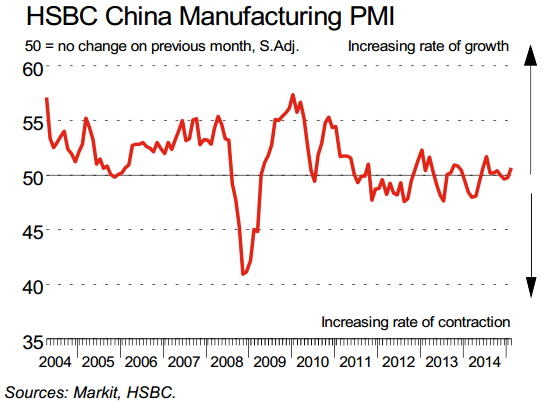

HSBC/Markit Manufacturing PMI for February: 50.7

- expected 50.1

- prior was 49.7

- flash reading was 50.1 (and more here)

Over the weekend we got official PMIs:

Manufacturing PMI for February: 49.9

- expected 49.7

- prior was 49.8

Non-manufacturing PMI for February: 53.9

- prior was 53.7

aaaaaand .... a PBOC rate cut (more here)

From the HSBC report:

Key points:

- Stronger expansions of both output and total new orders...

- ...but new export work contracts for the first time since April 2014

- Input prices continue to fall sharply

Commenting on the China Manufacturing PMI™ survey,

Annabel Fiddes, Economist at Markit said:

- "China's manufacturing sector saw an improvement in overall operating conditions in February, with companies registering the strongest expansion of output since last summer while total new business also rose at a faster rate. However, the renewed fall in new export orders suggests that foreign demand has weakened, while manufacturers continued to cut their staff numbers (albeit fractionally). Meanwhile, marked reductions in both input and output prices indicated that deflationary pressures persist."

-

The AUD hasn't shown much response (its up a few tics) to what is a very surprisingly strong HSBC survey. Hmmmm. That isn't a good sign for the AUD I wouldn't think.