Forex news for February 27, 2015

- US Q4 GDP (2nd reading) 2.2% vs 2.0% expected

- Infograph: GDP lower. Inventory fall accounts for most of the decline

- US Q4 PCE qq +1.1% vs +1.1% exp

- German CPI Feb mm flash +0.9% vs +0.6% exp

- US January pending home sales +1.7% vs +2.0% exp

- Chicago PMI 45.8 vs 58.0 exp

- U Mich consumer sentiment (final) 95.4 vs 94.0 exp

- Baker Hughes rig count 1267 vs 1310 prior

- SNB Gov hints at why intervention abandoned

- Dudley: Risks of raising rates early, higher than raising rates late

- Greek bank rumors officially denied

- SNB's Moser says franc 'massively overvalued'

- OPEC continues to hike production - survey

- Cleveland Fed President Mester: Holding rates too low may erode confidence

- Fed vice-chair Fischer: Bond holdings continue to provide stimulus

- Bank of Japan Nakaso: Japan needs to re-anchor inflation expectations

- ECBs Constancio: Policy didn't cause Euro-area double-dip

- Feds Fischer: High probability of a rate hike this year

- CFTC Commitment of Traders Report for the week ending February 24th

- US Stocks ending February with strong gains on the month

- Forex technical analysis: EURUSD review for February 2015 and preview for March

Week end. Month end. Some quirky data.

The US GDP was not quirky. It came in at 2.2% - a little higher than expectations of 2.0%. This was still down from the preliminary reading of 2.6%. The main negative contributor was an decline in inventories. If GDP is going to go down, having the decline due to an inventory reduction is the best case scenario. At least there is a chance for a rebuilding of the inventories next quarter.

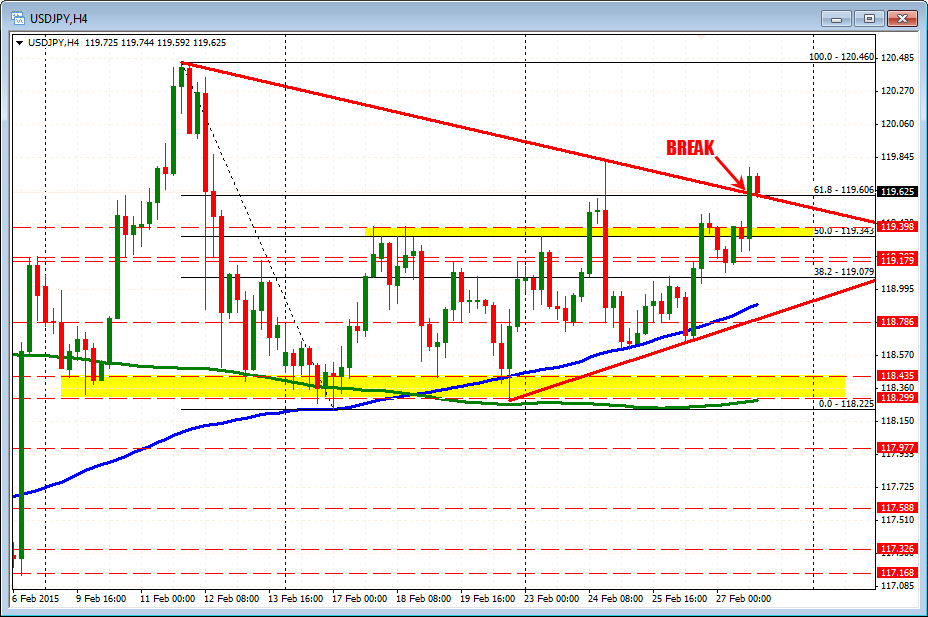

The quirky surprise came when the Chicago PMI came in at 45.8 vs. 58.0 estimate. It was the lowest reading since 2009. What happened? The blame is on the weather. The dollar should have gotten bashed on such a headline but after a 20 pip decline in the USDJPY to 119.26, the pair spent the rest of the day marching higher. Univ of Michigan consumer sentiment gave a little push (95.4 vs. 94.0 est,), but a break above a topside trend line, was also a help from a technical perspective.

The EURUSD chopped around in the NY session and ended little changed on the day. Given the 160 pip tumble yesterday, I am not all that surprised that traders took a breather today. Nevertheless, the pair is entering March with more of a bearish bias - thanks to the sharp fall on Thursday.

The USDCHF - like the USDJPY - made a break to the highs after falling briefly below the 200 hour MA after the Chicago number. The high extended up to the high for the week /month at 0.9546 but stalled The 100 day MA is at 0.9537. The price closed at 0.9533. Does the pair go above the 100 day MA in the new month or stay below it? That will be what traders will debate on Monday. The CHF was the weakest of the major currencies in February, after being the strongest currency in January- thanks to the SNB de-peg. I guess you can blame the SNB for the CHF being the weakest as well, as it was the threat of intervention/more rate cuts that led to the increased pressure.

Cable was higher on the day, but the pair had five separate 45 to 63 pip laps to the upside and downside. Friday, month end and a quirky piece of data is to blame.

Have a great, safe, joyful and peaceful weekend!