Trades above and below 38.2% retracement

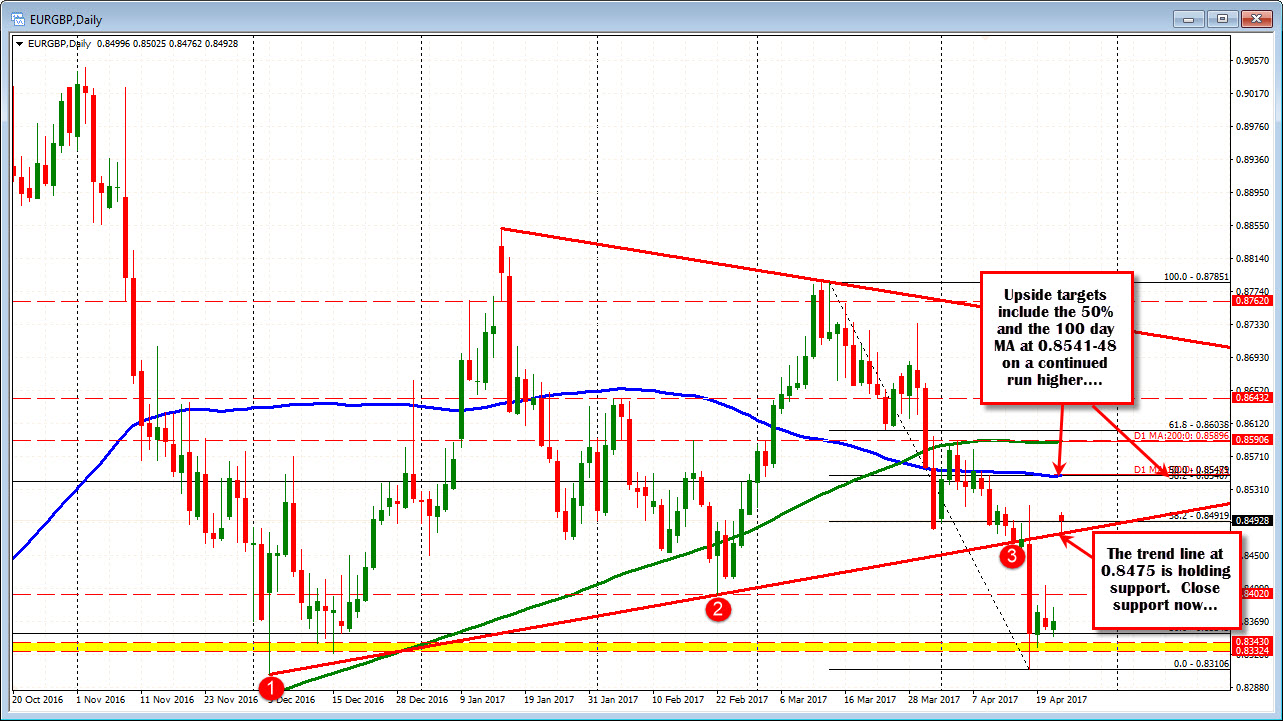

The EURGBP also gapped higher after French election results, with the price moving back above a broken trend line at 0.8475 on the daily chart. According to my chart, the low today has found support against that trend line level.

The 38.2% of the move down from the March high comes in at 0.8491 and the price has been waffling above and below that retracement level. Above that on the daily chart is the 50% of the same move down and the 100 day MA at 0.8545 area. Keep that level in mind as a potential target level on a continuation of the move higher today.

Drilling down to the 4-hour chart, in addition to the 38.2% at 0.8491, the 100 bar MA on the 4-hour chart is also at the level. That increases the areas importance. The market is stalling around the dual levels as it contemplates the next move.

The high price from last week comes in at 0.85106. That level was also home to swing levels from April 6th and April 12th (see red circles in the chart below). The high today has reached 0.8502 on my chart. A move above the 0.8510 should solicit more buying momentum.

Right now, the market is toying with "go higher" or "go lower" away from the 38.2% with hurdles on either side (at 0.8475 and 0.8510 respectively) to help confirm a potential break technically.