Chicago much weaker. Michigan Consumer Confidence better.

The Chicago PMI came in much weaker than expectations at 45.8 vs 58.0 (really?). The miss was so big, the market reacted as if it was a mistake. Weather likely had a play in the weakness but weather is always a problem in Chicago, isn't it? In any case, there was a 20 or so pip reaction initially.

The Michigan Consumer Confidence final reading was stronger at 95.4 vs 94.0 estimate. That might be thought to benefit the greenback, but there has been a move back to the upside. Go figure.

As mentioned earlier, it is month end and also week end. The choppy conditions seems to suggest that perhaps there are some squaring up/lack of liquidity in the market. Of course I don't really know but the price action is certainly suggestive.

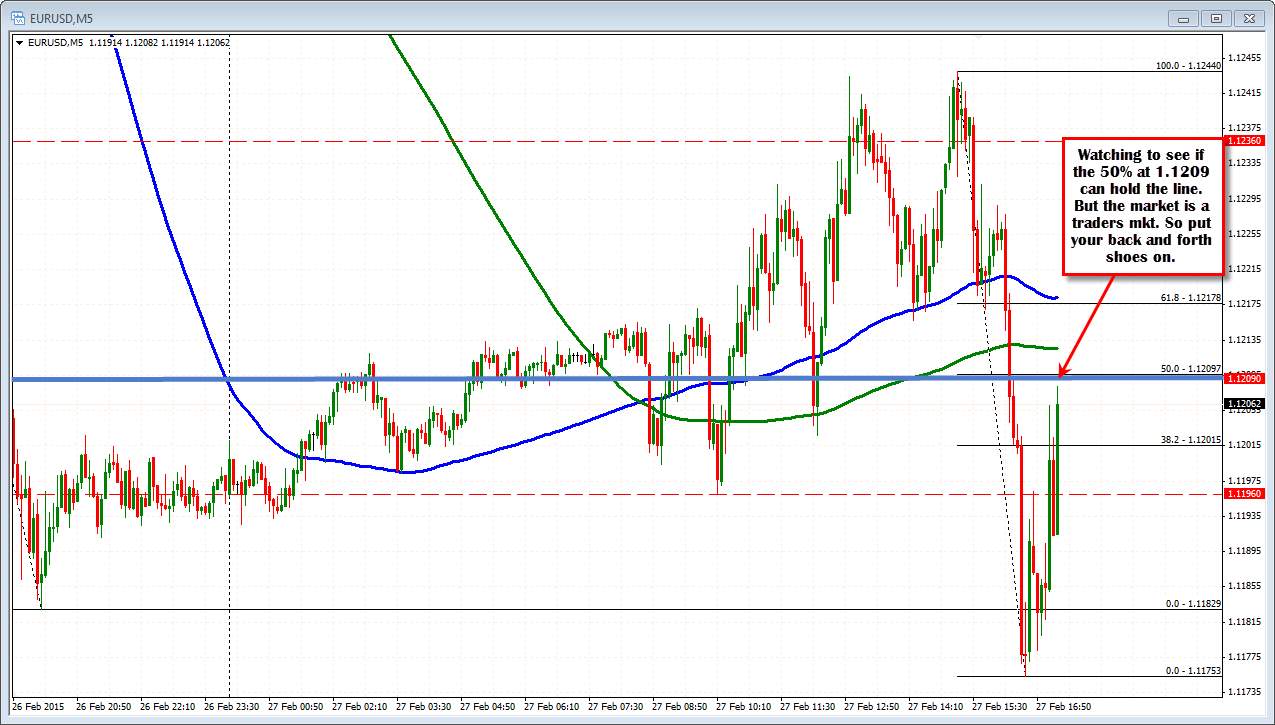

Keeping an eye on the 1.1209 level on the correction. It is the 50% of the days range and also the 61.8% of the move up from the 2000 year low to the 2008 year high. Looking to test that level as I type.

PS. EURJPY bounced off the lows again (well failed) and that is an influence it seems