61.8% of the lifetime low to high range slows rally

The 61.8% of the low to high trading range for the EURUSD was tested at the 1.1209 level in overnight trading (high reached 1.1211) but momentum failed and the price started to rotate back to the downside. PPI for the EU was released for January and it showed a sharp -0.9% decline. The ECB is expected to keep rates unchanged at their meeting on Thursday. QE is going to start sometime this month (read Ryan's post on QE and what to expect HERE.)

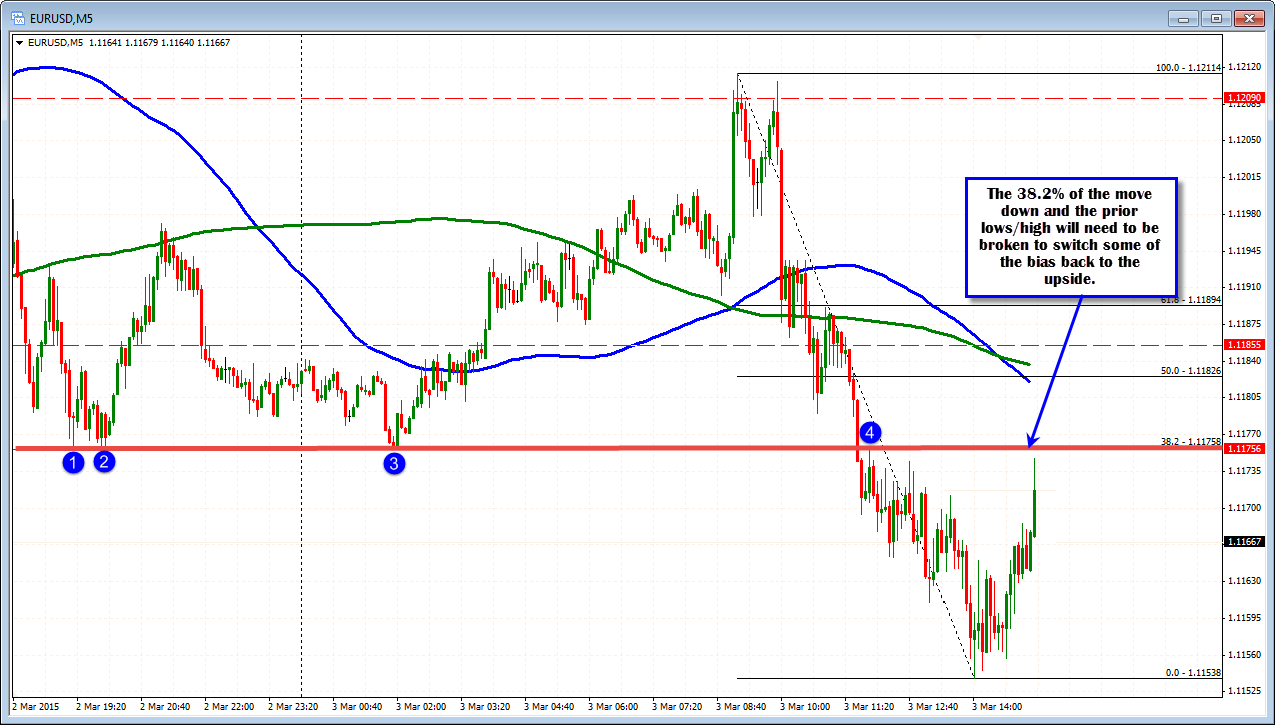

The EURUSD has made new lows (going back to January 26) in trading as the US enters for the day. The low surpassed the low from yesterday at the 1.11592 but only made it to 1.11538 before rebounding. If the pair is going to see further upside in trading today, the 1.11758 represents the 38.2% of the move down today. It also is the low from NY session yesterday, and the low from the Far East session today. Look for a test to find some selling. If there is a break above there is further upside resistance against the 100 and 200 bar MA (blue and green line in the chart below) and the 50% retracement. I would expect that this area should cap the correction.

It seems the market is still in a trading environment. The ability to stay below the 1.1209 level keeps a lid on it and has the sellers more in control, but it is not running away either..

y