Claws back losses

Yields on US debt are up 1 to 3 bps.

Stocks are trading near highs.

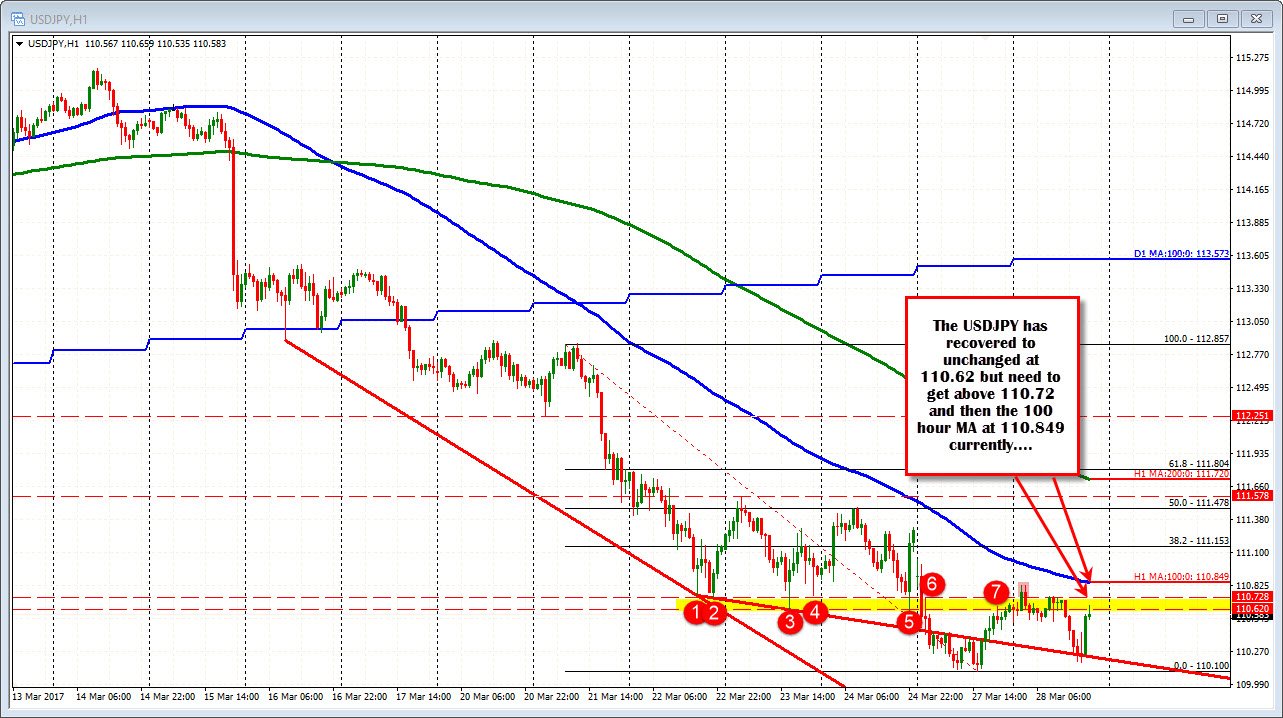

The USDJPY was down about 50 pips about an hour and 1/2 ago, but we are now near unchanged at 110.66. Come back for the pair.

Looking at the hourly chart, the pair entered the 110.62-72 area where low from last Weds, Thurs and Friday stalled falls (see yellow area in the chart above). A move back above that area would be more bullish, but the price still has to climb above the 100 hour MA at the 110.849 level (blue line in the chart above). As mentioned in an earlier post, the 100 hour MA has not been breached since March 14th. In fact we have not really gotten close to that MA line over the last few weeks of trading.

So...

- The price is recovering.

- The low today could not get below yesterday's lows.

- We are back near unchanged....

- The data was good today which should be supportive

- The 10 year yields are helping and may be making their own bottom. The low was 2.35% today and 2.34% yesterday. Looking at the chart below, a move above the 100 hour MA at 2.396% should give yields a boost to the upside.

BUT...

There is more work to do to get the run higher going.

- We need to get positive on the day and get above that 100 hour MA ultimately.

- For US interest rates, a move in the 10 year above 2.396% would be helpful to a bullish cause.

Watch. The technical clues are there.