This via Westpac:

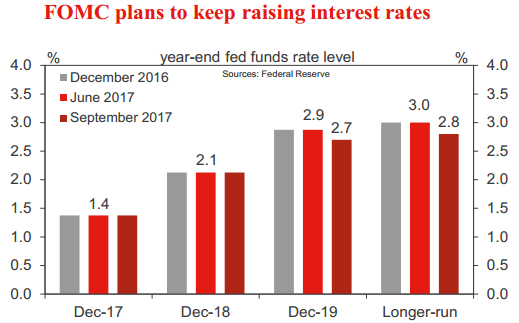

- A rate hike at this meeting is the expectation of all in the market, having been well telegraphed by the FOMC since the decision to begin balance sheet normalisation back in September.

- Justification for the decision can be found in continued above trend GDP growth, led by the consumer, as well as a labour market that has well and truly achieved full employment. Wages growth continues to lag, but the FOMC remain expectant. Confidence and financial conditions are also very supportive for the economy, hence the downside risks of a rate hike are negligible.

- Inflation on a PCE basis is expected to firm slowly to target over the coming two to three years. If this occurs and we see two additional hikes in 2018, then the Fed Funds rate will remain neutral to the economy, sustaining growth.

--

Earlier: