The USD is mixed

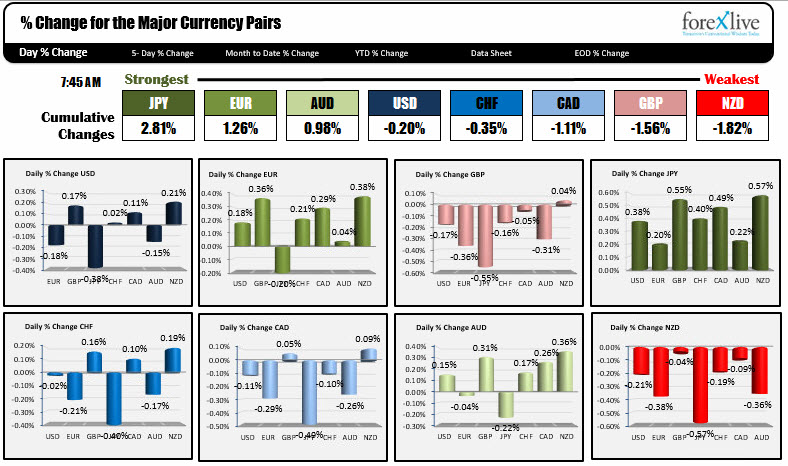

As North American traders enter for the day, the JPY is the strongest, while the NZD is the weakest. The USD is mixed with modest gains vs the GBP, CAD, and NZD, and modest losses vs the EUR, JPY and AUD. The CHF is sitting near unchanged. Today is D-Day for the US government. The House has sent the "kick the can" bill to the Senate, where the 60 votes needed to block a filibuster are not there (yet?). If not passed by midnight tonight, the government will start shutting down "nonessential operations".

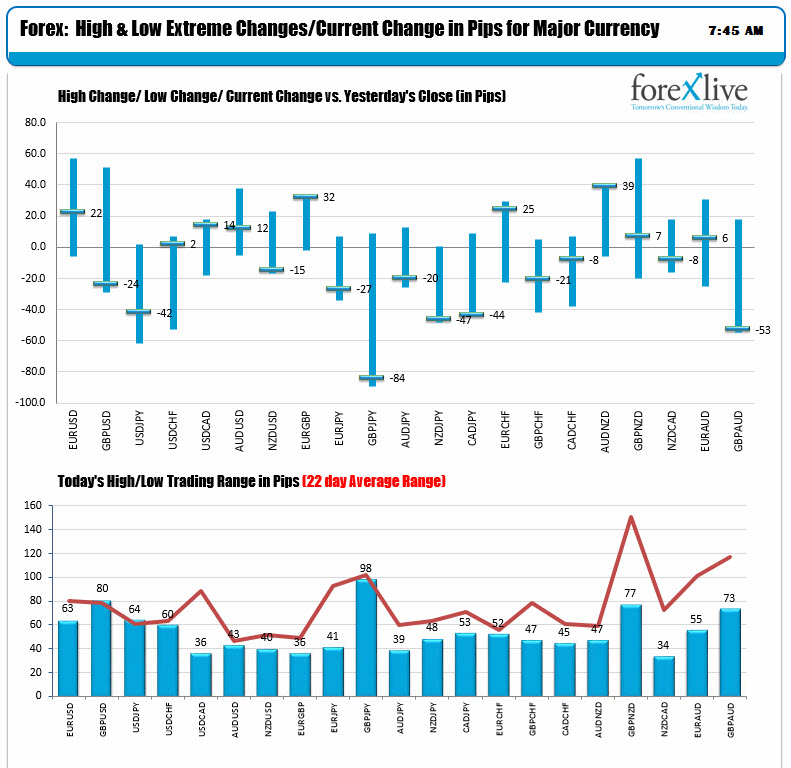

Most of the trading ranges are sitting below the 22 day average trading range line (red line in the chart below). There is some room for extensions. The GBPUSD has reversed hard after making a new post -Brexit high and reversing after weaker retail sales data. It trades near low levels of the day.

In other markets:

- Spot gold is up $6.30 on concerns about the US debt extension bill. It trades at $1333.56

- WTI crude oil futures are trading down $.71 or -1.11% at $63.24

- Bitcoin is trading up about $350 at $11,981. On Bitstamp the price moved above the 100 hour moving average at $11,802

- In the US stock market, premarket levels are higher. Dow futures are up about 40 points. NASDAQ futures are up about 20 points. S&P futures are up about 4 points.

- US yields are little changed. 2 year 2.044%, unchanged. five-year 2.415%, down -0.3 basis points. 10 year 2.6259%, unchanged. Thirty-year 2.905%, unchanged

- European stock indices are trading higher. German DAX of 0.97%. France's CAC up 0.38%. UK's FTSE up 0.2%. Spain's Ibex up 0.35%. Italy's FTSE MIB up 0.71%