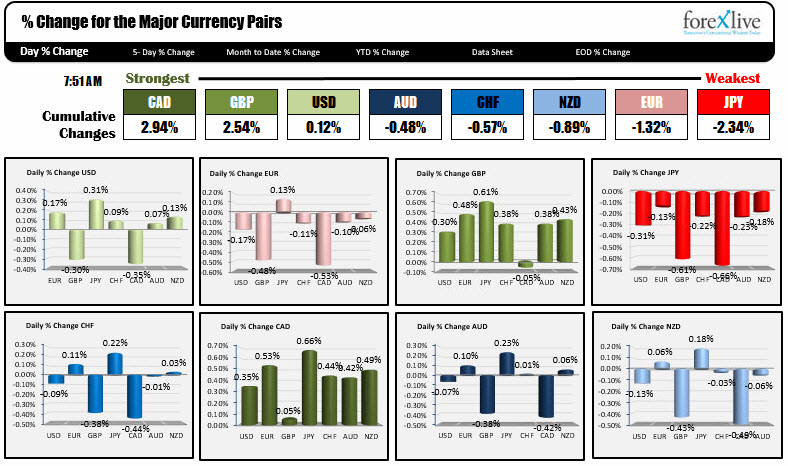

The CAD is the strongest. The JPY is the weakest.

As the NA traders enter for the day, the snapshot of the strongest and weakest currencies shows that the CAD is the strongest, while the JPY is the weakest. The CAD is benefiting from the news that Trump said he will not repeal NAFTA but will renegotiate terms with both Mexico and Canada. The JPY is down the most against the CAD and the GBP, but is also weaker against the other major currency pairs.

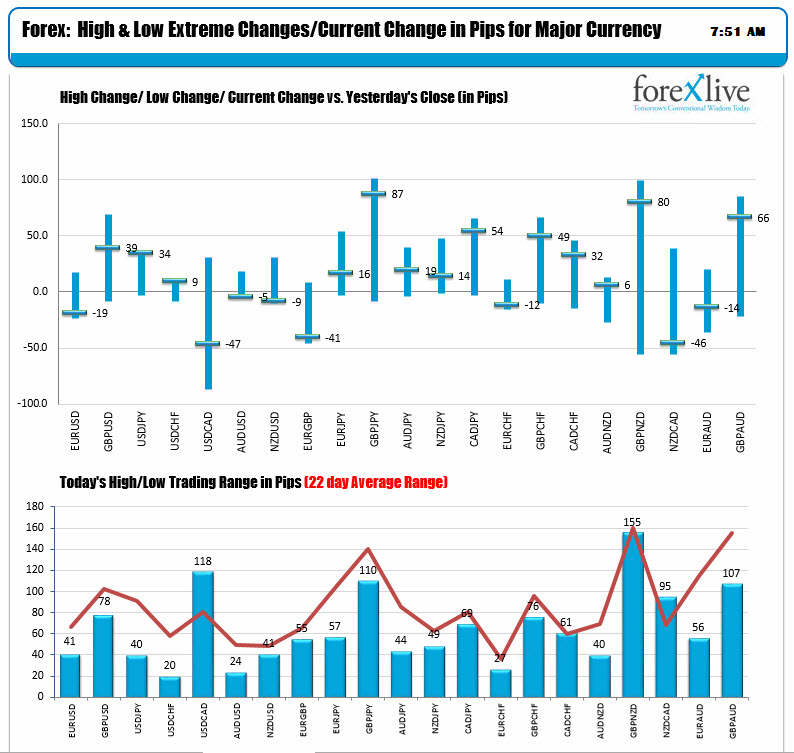

Looking at the changes and ranges, the EURUSD is trading near the lows as the ECB keeps rates unchanged. ECB's Draghi will be speaking at 8:30 AM ET/1230 GMT. Germany's CPI came in at 2.0% vs 1.9% estimate YoY. The MoM was also better than expectations at 0.0% vs -0.1% estimate. The EURUSD is rebounded a little on the news. The EURUSD range is still narrow at 41 pips. The USDCAD range is over the 22 day average today. The other major pairs are below the red line.

At 8:30 AM ET/1230 GMT along with the ECB presser:

- US Wholesale inventories are expected to rise by 0.2% vs +0.4% last

- US Advanced goods trade balance is expected to come in at -$65.2B vs -$63.9B last

- US Durable goods are expected to rise by 1.3% vs 1.8% last. Ex Trans is expected to rise by 0.4% vs 0.5% last.

- US initial claims for the current week is expected at 245K vs 244K last

At 10 AM US Pending home sales are expected to decline by -1.0% vs 5.5%.

Earnings releases today include:

- Alphabet,

- Amazon,

- Intel,

- Microsoft

A snapshot of other markets shows:

- US yields are higher by about 1 BP. 2 year 1.2737%, unchanged, 5 year 1.8388%, +1 BP, 10 year 2.3107%, up 0.7 BP, 30 year 2.968%, up 0.8 BP

- Spot gold is trading down -$5.25 to $1263.99

- WTi Crude is down -$0.94 to $48.70

- US stock futures are trading higher with the S&P trading up +3.5 points, the Nasdaq is trading up +11 and the Dow is trading up +34 points