9th consecutive day with lower lows

The USDCAD has now had a lower low for the 9th consecutive day.

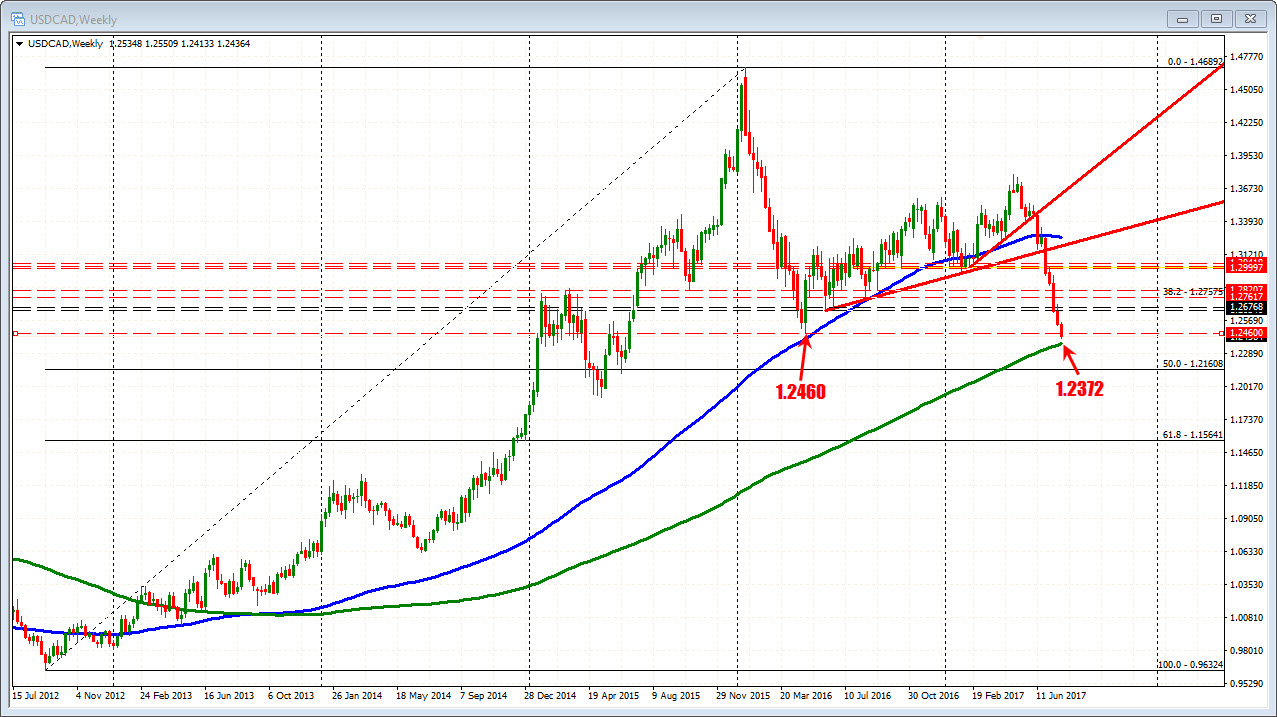

For this pair, the price moved below the low from yesterday, then the lower trend line at 1.2461. That level also corresponded with the low from 2016 at 1.2460.

That break triggered stops and a move to an even lower trend line at 1.24164.

A move below that level and traders will start to focus on the 200 week MA at 1.2372.

Risk for shorts?

You have to use the 1.2461 area now. Stay below is keeps the bears in control.

PS. The price traded above the 100 hour MA (blue line on the hourly chart) for a few minutes at the high of the day (sneaking). It was the first look above the level since July 12th. The failure to gather more upside momentum, turned the buyers into sellers.

In the last hour or so, the Fed and technical breaks, gave the pair the shove away from that MA line (again). The 100 hour MA remains as a level that needs to be broken to the upside if this pair is to recover.